You and your spouse were a team.

And worked hard throughout your marriage to get to where you are financially.

But now that you’re facing a divorce, you're wondering is Washington a community property state? And if so, you have questions about how the division of your marital assets and debts will be handled.

You’ve heard that for couples ending a marriage in a community property state, spouses divide assets and debts 50-50, but you don't exactly know how to determine what property should be included in your negotiations (aka "community property") and what property should be left out (aka "separate property.")

Then there's the income, assets and/or liabilities that were co-mingled during the marriage. How do you deal with them?

And you want to know if and how you and your spouse can get a say in creating a community property agreement you both think is fair, even if that means not splitting everything down the middle.

This post about Washington State community property.

Is Washington a Community Property State?

Yes, Washington State is a community property state. And when it comes to divorce, dividing community property is one of four topics that must be resolved. The others are:

For the purpose of this post, a marital community is two individuals who legally marry or are registered domestic partners. And the marital property and/or debts accumulated by one or both spouses is "community property."

Some items considered community property Washington may seem obvious such as savings accounts both spouses contributed to during the marriage, or a home or other real estate purchased using community funds.

But others may not be as clear, such as a 401(k), since these types of accounts can only be titled in one party's name. But, if the funds contained in the 401(k) were accumulated during the marriage, they still belong to both spouses as members of the community.

Just like with assets, any debts accumulated during the marriage also belong to the community.

What is Separate Property in a Washington State Divorce?

Complicating matters of property division in a Washington divorce is separate property, which can actually take four different forms.

- The first type of separate property is income or property that can be shown as belonging to either spouse prior to their marriage, and was kept completely separate while they were together. Think for example a baseball card collection you had since you were a kid or student loan debt you brought with you into the marriage.

- The second type of separate property is that which is defined by the State of Washington as separate property. For example, inheritances or gifts you or your spouse received during the marriage.

- The third type of separate property is an asset purchased by either spouse using separate funds. For example, if you took the inheritance you received above (as separate property) and used it to buy yourself a classic car.

- And fourth type of separate property is assets or debts acquired by a spouse after the couple was living apart - again, using separate income.

What is Transmutation (Transmuted Property) in a Washington State Divorce?

While it may sound like something out of a science fiction movie, transmutation is the term used to describe how a piece of property characterized one way, changes during the marriage.

As a married couple in Washington State, spouses may change:

- Separate property into community property; or

- Community property into separate property; or

- The separate property of one party, into the separate property of the other party.

And while agreeing to change the characterization of property from one form to another is important, it also needs to be clearly spelled out in writing. Documenting mutual agreement that the property in question changed from one type of property to another.

Without documentation of mutual agreement that the property in question changed from one type to another, it will be necessary to prove the transmutation of the property using something called the tracing principle.

Otherwise, the asset or liability will remain in its original form.

How Does Community Property Work with Respect to Division of Assets and Liabilities?

Some people think when it comes to divorce, community property means that everything the two of them owned or owed while married will be split 50-50. And anything either spouse owned or owed prior to being married is theirs to keep (or repay.)

But like most issues in divorce, resolving community property is not as easy as you might think.

There are a few things you need to understand about the challenges surrounding the division of community property and debts in a Washington divorce:

- Community property and debts in a Washington divorce do not have to be split equally down the middle if the parties mutually agree otherwise;

- This topic has less to do with divorce law or community property law and more to do with money and negotiation;

- There is more than meets the eye on this subject and in the majority of cases, this issue is much too complex for you and your spouse to try to resolve on your own.

That's why you’ll get the best community property agreement by mediating with us.

"There’s a lot more to dividing community property in a Washington divorce than just cutting everything in half and calling it a day.

You might not realize the flexibility you and your spouse have to come to an agreement you both find fair. Even if that agreement doesn’t result in a 50-50 split of your community assets and debts.

But because dividing marital property and debts in a Washington divorce is a complex financial matter, in order to get a settlement that's equitable to both of you, it’s critical to work with an experienced divorce mediator with a financial acumen like me."

- Divorce Mediator Joe Dillon

When it Comes to Community Property Division, Equal Doesn’t Necessarily Mean Fair.

If there’s one thing I hear time and time again from client couples, it’s that they both want a fair divorce outcome and that includes a fair community property agreement.

But how one spouse defines fair, is most likely different than how their spouse defines it.

Maybe for you, fair means 50/50. Split everything down the middle and your settlement becomes "I take my share, and you take yours." But to your spouse, fair might be more like 55/45, 60/40, or some other percentage that doesn't have each of you walking away with half.

Sure 50-50 might work when the stakes aren't that high, like when sharing a sandwich, but when it comes time to divide property in a divorce, those few percentage points may make the difference between "sounds good to me" and "see you in court!"

If you’re in a position where you have to split everything 50-50 because you live in a community property state, giving or getting only half of your assets might not meet your own definition of fair.

To better explain the concept of differing definitions of fair, consider this example of Dave and Chris, two brothers who decided to purchase a 1968 Corvette Stingray, and restore it to its original glory.

Ever since they were little kids, Dave and Chris loved Corvettes.

They had Corvette posters on their walls, replica Corvette models, and even two of those cool race car beds shaped like, you guessed it, Corvettes!

They loved cars so much that they both grew up and became be auto mechanics. So when Dave came across an ad for a 1968 Corvette Stingray for sale in Seattle that needed a little love, he called Chris immediately and told him their childhood dream was about to come true! How great would it be to own their childhood dream car, and get to restore it with his brother!

After a bit of back-and-forth with the seller, Dave and Chris bought the car, each contributing 50% of the sale price, and they had the car towed to Dave's house, where it would live in his garage until they got it in perfect working order.

The brothers decided upfront that once the car was fully restored, they would each get to use it equally for alternating one-week periods, starting and ending on Sunday evenings.

Unfortunately, when it came time to begin the project, Chris was disinterested in helping Dave. He liked the idea of owning a Corvette, just not the idea of restoring one. But Dave was not to be deterred. This was his dream and he decided that if Chris wasn't going to help, he would do the renovation by himself.

The weeks and months passed, and the car went from what could only be described as "a hunk of metal on four wheels" to a magnificent thing of beauty. Dave restored everything to its original specs - right down to the chrome knobs on the original AM / FM radio!

When Dave turned the key and fired up the engine, he was ecstatic. He couldn't believe he actually owned a 1968 Corvette Stingray!

As he pulled out of the driveway for the very first time, he thought back to the deal he and Chris made when they first bought the car. And how they would each share equally in its use. Dave was now a bit indifferent about this arrangement, but "a deal's a deal" he thought to himself.

After Dave's first week with the car, he drove it over to Chris's house that Sunday and was prepared to hand over the keys when Chris said, "Hi Dave, what are you doing here?"

"I'm dropping off the car as we agreed," Dave said.

Chris laughed. "Do you really think I still expect you to share the car with me equally? You did all the work!"

"But we had a deal," Dave said. "That we would each share it equally as that's what we both thought was fair."

"Listen, little brother, you did the entire renovation by yourself," Chris said. "Why don't you keep it for three weeks every month, and I'll take it for one."

Dave was surprised by Chris' generosity. Especially since sharing wasn't one of his strong suits when they were growing up! But who was he to argue? Dave said his goodbyes and kept the car for two more weeks.

What are your thoughts about Chris and Dave and how they split the car? Was it fair to both of them?

On the one hand, maybe you’re thinking it wasn’t fair because Chris paid the same amount of money as Dave did for the car. And they did make a deal to share use of the car equally.

On the other hand, maybe you think this new arrangement was fair because Dave did all the restoration work and paid for all the replacement parts.

In any event, Dave and Chris were both happy with the way the use of the car was divided. In other words, each found this outcome to be fair.

Even though it wasn’t a 50/50 split.

So as you can see, one’s definition of fair, can change based on the situation.

What does this example have to do with community property division in divorce?

Whether you’re dividing community property and debts in a divorce or the use of a classic car, fair is subjective.

Not only that, but your definition of fair might vary from issue-to-issue.

For example, you might think a 50-50 split of your joint savings account is fair because you and your spouse each worked to earn that money equally.

But what if your spouse decided the two of you would become the next Chip and Joanna Gaines? And without your knowing, bought a pick-up truck, power tools, paint, plaster, drywall, lumber, and other assorted equipment, and in the process, accumulated some significant debt.

In this case, you'd probably want them to take on that liability separately as you have no interest in becoming the next HGTV real estate sensation.

Hopefully, you’re starting to understand one of the many challenges surrounding community property.

Couples often find that defining what’s fair and coming to agreements on splitting their assets in a divorce is not always so easy to do.

Community Property vs Separate Property is Not Always Easy to Identify.

Now, let’s take a closer look at community property versus separate property. And what can happen when it becomes co-mingled.

Because like all issues that need to be settled in a divorce, pinpointing community vs. separate property isn’t always so clear-cut.

To better explain the challenges of untangling co-mingled assets and debts, meet Jeff and Emma. Two busy professionals whose lives are a never-ending stream of chaos:

Jeff and Emma met while working as Directors of Marketing and Finance, respectively, at a large Redmond, Washington technology company. Their lives were filled with daily non-stop meetings, after-hours phone calls, and endless e-mails, texts, and Slack messages.

It's a miracle they even found time while dating to get to know each other at all!

Prior to getting married, Jeff and Emma each owned houses. Because Emma's home was bigger than Jeff's, they decided to make hers their marital residence, and keep Jeff's house as a rental property.

And while they kept telling themselves that someday they would get around to putting each other's names on the deed to their respective properties, given their busy lives, they never got around to it. Time passed, and eventually the idea was forgotten. They figured as long as they were each contributing to the costs to run what had become "their" marital home, things would work out just fine.

A year after they were married, Jeff thought some improvements were needed to their now marital residence (i.e. Emma's house), so $80,000 was spent on an in-ground swimming pool and a new roof, with the funds for these improvements coming from a home equity loan Jeff took out on the "rental" residence (i.e. Jeff's house.)

At the time, it seemed like a no-brainer as the monthly loan payment could be easily made using the monthly rent received from Jeff's former residence.

But two years after the work was completed, Jeff tells Emma he wants a divorce and suggests they each keep the house they came into the marriage with. All he asks is that she repay him the $80,000 used to renovate "her" house.

But Emma strongly disagrees.

She explains to Jeff that swimming pools and roofs don't add any value to the price of a house, and while she understands his position, she feels since the debt was taken out on "his" home, and is in his name, it should be his alone to repay.

Jeff feels that's unfair because not only did he pay for half of all the monthly costs for "Emma's house" while they lived there together, he now plans on moving back into "his" house, and will no longer receive any rent payments. He alone will now have to cover both the mortgage and the home equity loan!

How is that fair?

"But the pool and the new roof were your ideas," Emma tells him. And around and around they went...

What do you think about this example?

Was separate property used to improve a separate asset or a community asset?

And now that Jeff and Emma are getting divorced, who should be responsible for the debt? Should Jeff get a share of Emma's house since he paid half the costs while living there? Or should it be considered his spouse's separate property? Should Emma get a share of the rent received on Jeff's house?

As you can see, in this example (and many others just like it), coming to agreements on the division of property and debt in a divorce is complicated. Especially when things are co-mingled.

There is more than meets the eye when it comes to community property and division of assets and debts.

While it may seem like splitting everything right down the middle would be the easiest way to approach things, as you've been learning, not every divorcing couple fits neatly into the 50-50 box.

As unique as the individuals who enter into them, no two marriages, divorces, or situations are exactly the same.

And that can make coming to an agreement on what each spouse believes is fair, as well as determining which assets and liabilities are considered community vs. separate property, quite tricky.

The division of assets and liabilities in a divorce in Washington State is often much too complex for you to try to resolve on your own.

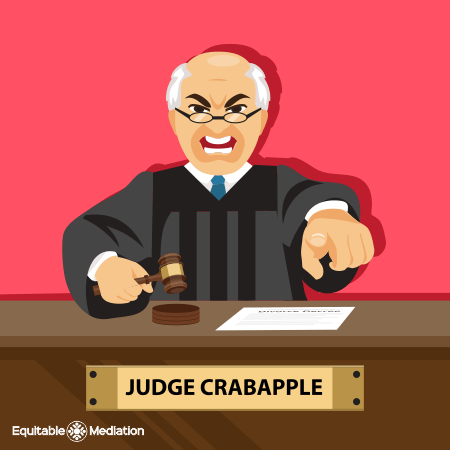

But when the law gets involved with resolving community property, it’s a problem.

So far I've been sharing how everyone has a different definition of what’s fair.

So far I've been sharing how everyone has a different definition of what’s fair.

And how challenging it can be to determine what a community and/or a separate asset or liability might be. Especially when they’ve been co-mingled over the years, or changed from one form to the other.

But if that wasn't enough to worry about, there’s one more thing you need to know...

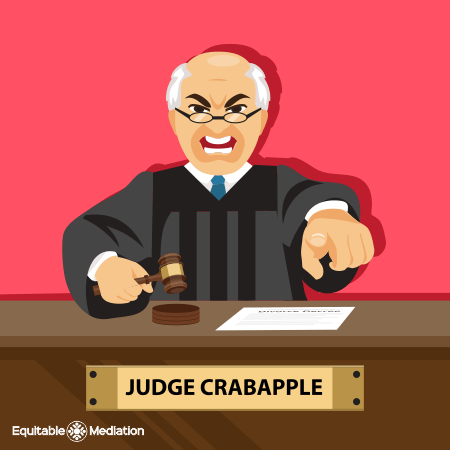

If you hire a divorce attorney who fail to help you come to an agreement with your spouse, guess where you're headed - Washington court!

And in a litigated divorce, the division of assets and liabilities is determined by a family law judge.

So what you and your spouse each think is fair isn't going to matter much anymore as there's a high probability that everything you own and owe will be split right down the middle.

A family law judge doesn’t care about what you think is fair.

They’ll dictate the terms of your settlement, while greatly increasing the likelihood that neither spouse will wind up with something they find fair.

Talk about a lose-lose proposition!

Consider this example of Rick and Suzanne

Rick is 50, Suzanne is 59, they’ve been married 27 years, there’s no dispute about pre-marital assets, and Suzanne wants the divorce.

Rick and Suzanne determine the value of all of their marital assets and their two largest are Rick's business which is worth $900,000, and their retirement account, which is worth $750,000.

Because Suzanne is closer to retirement, she’s willing to let Rick keep 100% of the value of his business in exchange for her keeping 100% of the retirement funds. He wants to continue to grow the business, while Suzanne wants to start planning for the day when she's no longer working.

In divorce litigation, you really never know which side of an issue a judge will rule in court.

But even if a judge rules in court that everything is to be cut everything in half, in this situation, it’s still not going to be a favorable outcome for either Rick or Suzanne because it's not what either of them wants or finds fair.

Not to mention the judges' ruling doesn't serve either of their stated interests!

Rick and Suzanne are far better off discussing and coming to a settlement agreement they each find fair. Instead of having divorce attorneys or a family law judge force one upon them.

Remember, when that gavel comes down in a court of law, you don’t get a say.

That’s why it’s better to negotiate community property division. Which is exactly what mediation is all about.

In divorce mediation, you and your spouse get to decide - and come to an agreement you both agree is fair - out of Washington state courts - instead of letting your future be decided by a stranger.

You will get the best community property agreement by mediating with us.

Using our extensive financial knowledge of the complexities of community property, we’ll help you and your spouse determine which of your income, assets, and liabilities are subject to division.

Using our extensive financial knowledge of the complexities of community property, we’ll help you and your spouse determine which of your income, assets, and liabilities are subject to division.

We’ll actively guide you through negotiations on areas of disagreement while empowering and helping you to create an agreement you both find fair.

We’ll also make sure your agreement improves cash flow, minimizes tax issues, and avoids penalties, whenever possible.

And if you weren’t the spouse who managed the household finances, not to worry. We’ll balance the playing field by taking the time to explain in detail what everything means and how it will impact you.

Now, and in the future.

Equitable Mediation enables you to have a fair divorce.

Early in the process?

The choices you make before you start your divorce are critical.

But you can only make smart choices if you take the time to prepare first!

Other Useful Resources:

So far I've been sharing how everyone has a different definition of what’s fair.

So far I've been sharing how everyone has a different definition of what’s fair. Using our extensive financial knowledge of the complexities of community property, we’ll help you and your spouse determine which of your income, assets, and liabilities are subject to division.

Using our extensive financial knowledge of the complexities of community property, we’ll help you and your spouse determine which of your income, assets, and liabilities are subject to division.