When you’re going through a divorce in Washington, the financial uncertainty can feel overwhelming. One of the most confusing aspects? Understanding that spousal maintenance—what many states call alimony—actually happens in two distinct phases. The support you might receive while your divorce is pending differs significantly from the maintenance you might be awarded after everything is finalized.

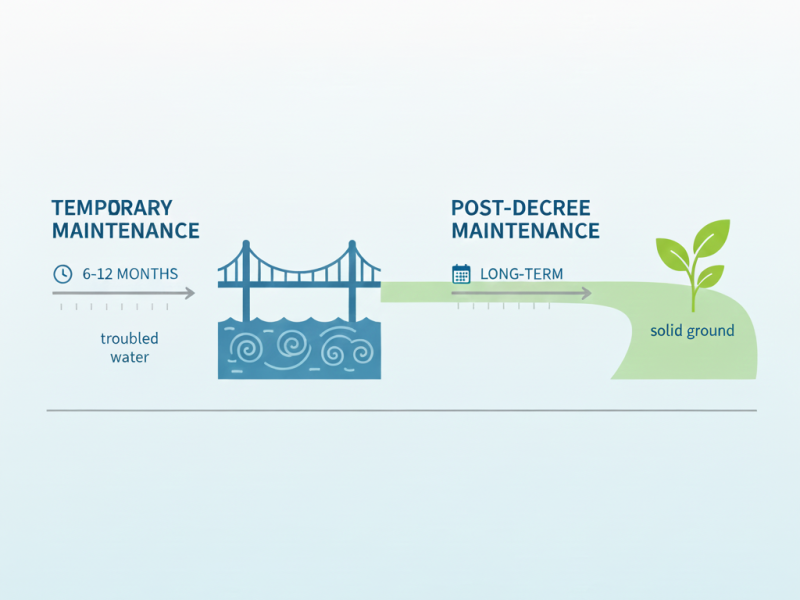

Think of it like this: temporary maintenance is the bridge that gets you from married life to divorced life, while long-term maintenance is about your financial foundation moving forward. Understanding both phases before you enter mediation can help you negotiate more strategically and avoid leaving money on the table.

Understanding Temporary Maintenance: Your Financial Bridge During Divorce

Maintenance pendente lite—which literally means “pending the litigation”—is temporary spousal support paid while your divorce is in progress. In Washington, this is typically called “temporary maintenance,” and it’s designed to maintain a standard of living close to what you had before the divorce while everything else is in flux.

Here’s why it matters: your community assets remain undivided, your finances are still legally intertwined, and one spouse might be living in the family home. At the same time, the other has taken on new rent. This temporary support keeps both households afloat during what can be a months-long process, providing stability when neither spouse has clarity about their post-divorce financial picture.

In mediation, couples often struggle with temporary maintenance because emotions run high. The spouse paying support might feel they’re being asked to maintain two households indefinitely. The spouse receiving support might worry that accepting “too little” sets a precedent. But here’s the reality: temporary maintenance is just that—temporary. What you agree to now doesn’t lock you into anything permanent.

The Strategic Approach to Negotiating Temporary Support

When approaching temporary maintenance in mediation, consider cash flow analysis rather than focusing on what feels “fair.” We’re looking at a simple yet crucial question: can both households continue to function until the divorce is finalized?

Create a realistic budget for each household during the separation period. I mean realistic—not the budget where you claim you can live on ramen noodles because you’re angry, and not the inflated budget where you list every conceivable expense to maximize your claim. Both approaches backfire.

What gets considered in Washington when determining temporary maintenance includes each spouse’s financial resources, but in mediation, you have much more flexibility. The key is approaching this as a practical cash flow problem, not a moral judgment about who deserves what.

One financial nuance that often gets overlooked: under current federal tax law, maintenance payments are neither deductible for the payor nor taxable to the recipient. This affects the real economic cost and benefit of any maintenance arrangement, so factor this into your negotiations rather than using outdated formulas based on tax deductibility.

Post-Decree Maintenance: Planning for Your Long-Term Financial Future

Post-decree maintenance—the support that continues after your divorce is finalized—requires an entirely different strategic approach. This is where understanding what matters in Washington becomes crucial, even in mediation.

Factors that come into play in Washington include the financial resources of each spouse after property division, the time needed for the spouse seeking maintenance to gain education or training for employment, the standard of living during the marriage, the duration of the marriage, the age and health of each spouse, and the ability of the payor spouse to meet their needs while paying maintenance.

Notice something important? The analysis happens after property division. This is where Washington’s community property system creates a unique dynamic. Unlike separate property states, where maintenance might compensate for unequal asset distribution, Washington starts with the presumption that community assets will be divided fairly. Post-decree maintenance addresses income disparities between spouses, not asset disparities.

Let me give you a real-world scenario. Imagine a marriage in which one spouse stayed home for 15 years while the other built a career. After a roughly equal property division, both spouses have $400,000 in assets. But one spouse earns $180,000 annually, and the other hasn’t been in the workforce for over a decade.

The property division appears equal on paper, but the disparity in earning capacity is enormous. This is precisely what post-decree maintenance is designed to address. The question isn’t whether one spouse “deserves” more property, but whether one spouse needs financial support to maintain a reasonable standard of living given their limited earning capacity.

The Financial Analysis Framework for Long-Term Maintenance

When evaluating long-term maintenance in mediation, I apply a comprehensive financial analysis framework, but with one crucial advantage over litigation: we can customize the solution to your specific situation.

First, we analyze the income side. What’s the payor spouse’s gross income and necessary expenses? Not every dollar of income is available for maintenance. Self-employed individuals might have business expenses that reduce available income. High earners might have deferred compensation or stock options that complicate the picture.

Next, we look at need. What does the recipient spouse actually need to live on? In Washington, maintaining the same standard of living after divorce isn’t expected—that would be impossible when one household becomes two. Instead, we’re looking at a reasonable standard of living that reflects the marital lifestyle.

Then comes the time horizon. How long should maintenance last? In Washington, maintenance can be temporary (for a specific duration), indefinite (which continues until modified or terminated), or eliminated. The duration depends on factors such as the length of the marriage, the time required to become employable, and the age of the recipient spouse.

Approaching Each Phase Strategically in Mediation

For temporary maintenance, focus on the bridge, not the destination. You’re solving a short-term cash flow problem, not determining what’s fair for the rest of your lives. Run the numbers on what each household actually needs during the proceedings and consider creative solutions—such as having the higher-earning spouse pay specific bills directly, rather than writing a check for maintenance.

For long-term maintenance, start by gathering comprehensive financial information about both spouses’ post-divorce financial pictures. This involves projecting income, understanding the impact of property division on each person’s assets and liabilities, and creating realistic budgets. I’ve seen couples reach tentative agreements on maintenance only to realize later that their assumptions about post-divorce finances were utterly wrong.

Think about your post-divorce earning trajectory. If you’ve been out of the workforce, what’s your realistic path back to employment? If you’re the higher earner, what’s your long-term income outlook?

In my experience, couples in mediation often prefer “rehabilitative maintenance”—support for a specific period that gives the lower-earning spouse time to become self-supporting. This provides certainty for both spouses. Some couples negotiate maintenance that steps down over time as the recipient spouse’s earning capacity increases. Others agree to indefinite maintenance, particularly in long marriages in which one spouse sacrificed career opportunities for the sake of the family.

The Mediation Advantage: Flexibility That Litigation Can’t Offer

Here’s what makes mediation powerful for maintenance negotiations: you can design solutions tailored to your specific situation rather than accepting a one-size-fits-all outcome from litigation.

Perhaps you could agree to lower monthly maintenance in exchange for a larger share of your retirement assets. Maybe you agree to maintain health insurance coverage as part of your support obligations. Consider structuring a lump sum buyout of maintenance if the payor spouse has sufficient liquid assets and both parties prefer a clean break.

These arrangements are nearly impossible to achieve through the rigid court process. In mediation, you have the freedom to think creatively about what actually solves your financial needs and concerns.

With my background in finance and extensive training from Harvard, MIT, and Northwestern, I help couples analyze maintenance arrangements from multiple angles. We look at cash flow implications, tax considerations, the impact on retirement planning, and long-term sustainability for both households. We can model different scenarios to see how various maintenance structures would affect both of you over 5, 10, or 20 years.

This comprehensive financial analysis is particularly valuable when you’re dealing with complex compensation structures, such as bonuses, stock options, or business income. Understanding how these income sources affect both temporary and long-term maintenance calculations helps you negotiate arrangements that are sustainable and fair.

The key is approaching both temporary and long-term maintenance as financial planning problems, not emotional battlegrounds. When you understand the two phases of support and the factors that influence each phase, you can negotiate from a position of knowledge rather than fear.

Moving Forward with Clarity

Understanding the difference between temporary and long-term spousal maintenance gives you a significant advantage as you enter divorce mediation. You know that what you negotiate for the short term doesn’t lock you into anything permanent. You know that post-decree maintenance analysis happens after property division, not before. And you know that Washington’s community property system creates a unique context for these negotiations.

Couples who approach maintenance negotiations with financial clarity and a willingness to problem-solve tend to reach better agreements than those who get stuck in emotional arguments about fairness. You don’t need to be a financial expert, but you do need to understand your financial reality and be willing to engage honestly with the numbers.

Working with an experienced mediator who understands both how Washington handles these issues and the financial complexities of maintenance can make an enormous difference. Rather than handing control to the litigation process where a judge who doesn’t know you makes decisions about your financial future, mediation lets you design solutions that reflect your actual priorities and circumstances. That level of control and customization helps you move forward with confidence rather than confusion.