If you’re facing divorce in Washington, figuring out spousal maintenance can feel overwhelming. Unlike child support, which has straightforward guidelines, maintenance has no formula. How Washington approaches spousal maintenance gives couples significant flexibility, which can feel frustratingly vague when you’re trying to plan your financial future.

The good news? In mediation, you can conduct a thorough financial analysis that goes far beyond surface-level numbers. As a mediator with an MBA in Finance, I guide couples through a comprehensive review to help them reach maintenance agreements grounded in real data rather than fear or emotion.

Beyond Surface-Level Numbers: The Real Financial Analysis

When couples come to me for mediation, they often arrive with basic numbers. “I make $150,000, and my budget is $6,000 monthly.” “I only make $75,000 and need $6,500 to live on.”

These are starting points, but nowhere near sufficient. My job is to guide you through a deeper analysis that examines not just your current earnings and spending, but also your financial landscape post-divorce. We’re essentially building financial projections for two separate households.

This starts with comprehensive documentation. You’ll need recent pay stubs, at least two years of tax returns, profit and loss statements if self-employed, bank and credit card statements, retirement account statements, and detailed expense records. Incomplete information leads to incomplete agreements that often fall apart later.

Income Analysis: More Complex Than You Think

Income seems straightforward until you dig into it. Even W-2 employees need to consider factors beyond their base salary. Do you receive bonuses or commissions? How consistent are they? Stock options vesting? Overtime pay?

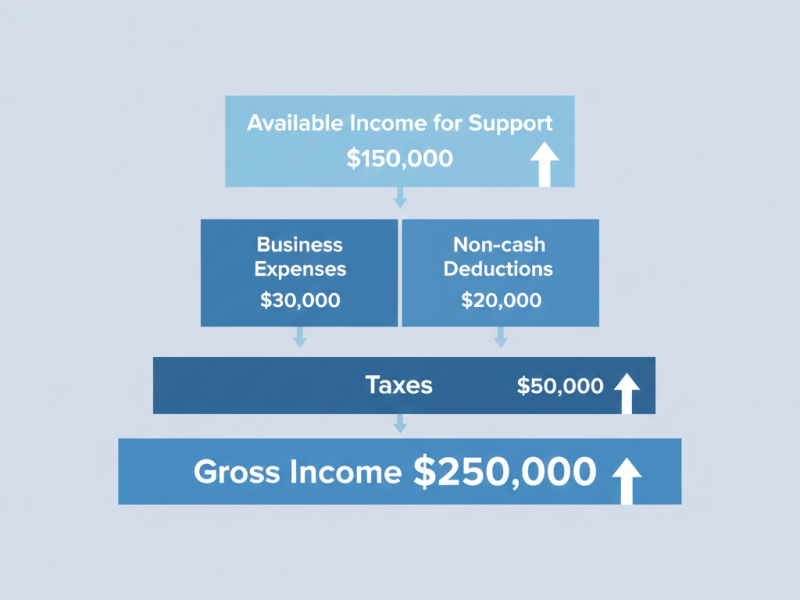

For self-employed individuals, analysis becomes significantly more complex. Your tax return shows one number, but is that your actual available income? Self-employed individuals often have legitimate business expenses that reduce taxable income but don’t necessarily reduce cash flow. We may need to reinstate depreciation or certain expenses to determine the actual economic income available for support accurately.

I’ve worked with business owners who claim they “only make $50,000 a year” per their tax return. Still, they’re driving a company car, the business pays their cell phone and health insurance, and they have significant discretionary spending running through the business. This isn’t about hiding income—it’s about understanding the complete economic picture.

We also consider income trends. Is your income likely to increase, decrease, or remain stable? If you’re in commission-based sales and the past two years were unusually high, is that sustainable? If you’ve been out of the workforce but have professional credentials, we need to assess your earning capacity—not just your current income—in a realistic way.

This kind of sophisticated income analysis is critical when you’re dealing with complex compensation structures. If your earnings involve bonuses, stock options, RSUs, or equity shares, it can be hard to see a clear way forward. With my MBA in finance and nearly 20 years of experience analyzing these situations, I can help you cut through the financial complexity to understand what income is actually available for support and what each spouse truly needs.

Post-Divorce Budget Reality: When One Household Becomes Two

Once we understand income, we turn to expenses. This is where couples struggle because they’re projecting expenses for a life they’re not yet living. During your marriage, you shared one household and its everyday expenses. Post-divorce, you’ll have two households with duplicated expenses.

We categorize expenses into fixed costs—such as housing, insurance, and car payments—and variable costs—such as groceries, utilities, and entertainment. But more importantly, we discuss how these change after divorce. What will your new housing cost? Can you afford to maintain the family home on your own? What about health insurance if you’ve been covered under your spouse’s plan?

One area that consistently surprises people is the actual cost of maintaining their lifestyle. During marriage, you may have spent around $1,200 monthly on groceries and dining. Post-divorce, each household might pay $800 monthly because there’s less efficiency.

I guide clients through creating two detailed post-divorce budgets accounting for all these changes. We’re not just looking at necessary expenses, but also costs reflecting the marital standard of living—gym memberships, kids’ activities, travel. What gets considered in Washington includes the standard of living established during marriage, so understanding what that actually costs is crucial.

Tax Implications in the Post-2019 Landscape

Here’s where my finance background becomes particularly valuable. Before 2019, maintenance was tax-deductible for the payor and taxable to the recipient. The Tax Cuts and Jobs Act changed everything. Maintenance paid under divorce agreements executed after December 31, 2018, is no longer deductible or taxable.

This fundamentally altered maintenance economics. If you’re the higher-earning spouse in the 32% federal tax bracket, every maintenance dollar you pay costs a whole dollar of after-tax income. Previously, it would have cost about 68 cents. For the recipient spouse in the 12% bracket, you’re receiving that dollar tax-free instead of netting 88 cents after taxes.

I help couples understand these implications when structuring agreements. Sometimes we adjust the maintenance amount based on the tax treatment. Other times, we explore alternative structures, such as a larger property division in place of ongoing maintenance, especially if the payor has substantial assets and both parties prefer a clean break.

We also consider how maintenance affects other tax aspects. How will filing status change? What about dependency exemptions? Will receiving maintenance affect eligibility for certain credits? These nuances matter when projecting your post-divorce financial picture.

Washington’s Community Property Factor

Washington’s community property system adds another layer. How maintenance gets determined happens after considering property division, not before. We need to understand not only income and expenses, but also the assets each spouse will receive.

Suppose the lower-earning spouse receives substantial liquid assets or income-producing property, which affects their maintenance needs if the higher-earning spouse takes on significant community debt, which in turn affects their ability to pay. I guide couples through a holistic analysis that considers property settlement and maintenance together.

Sometimes couples discover they’d prefer to structure their agreement differently. Perhaps one spouse would like a larger property settlement with reduced maintenance. Perhaps the other party would appreciate ongoing support alongside a smaller, immediate property division. These conversations only happen when you have complete financial clarity.

Modeling Different Scenarios in Mediation

Once we’ve gathered and analyzed financial information, we can have meaningful conversations grounded in reality. You’ll understand not just what “feels fair,” but what’s actually supportable given available resources.

I often create spreadsheets modeling different scenarios. What if maintenance is $2,000 per month for five years? What does each spouse’s budget look like? What if it’s $3,000 per month for three years? How do these structures affect each person’s financial stability? Can the paying spouse actually afford the proposed amount while meeting their own reasonable needs? Will the receiving spouse have sufficient resources to transition to self-sufficiency?

This level of analysis takes time and effort, but it’s worth it. I’ve seen couples reach agreements they both feel good about because they understand the numbers behind the decision. They’re agreeing because they’ve done the math, and the deal makes sense for their situation.

But we don’t just tackle the immediate challenges of determining maintenance. We help you anticipate how things might change down the road. What if the paying spouse loses their job or gets a significant promotion? What if the receiving spouse remarries or starts earning more? By planning for these potential changes now, we help you build flexibility into your agreement so you can move forward confidently, without constantly looking back or worrying about future disputes.

Essential Documentation to Gather

To conduct comprehensive financial analysis, gather at least two years of tax returns with all schedules, six months of pay stubs for both spouses, six months of bank and credit card statements, documentation of all debts, retirement and investment account statements, property appraisals or assessments, business valuations if applicable, detailed monthly expense documentation, and information about employer benefits including health insurance costs and retirement contributions.

Yes, it’s extensive. But in litigation, you’d provide all this anyway through formal discovery. In mediation, you share information voluntarily and collaboratively, which is faster, cheaper, and less adversarial.

Moving Forward with Clarity and Control

Having a mediator who can guide you through rigorous financial analysis transforms the negotiation process. Instead of taking positions based on fear or fighting over what might happen in court, you’re making decisions based on real data about income, expenses, assets, and tax implications.

In litigation, you’d be stuck with whatever amount a judge decides based on limited testimony and rigid guidelines. You’d have no control over creative solutions or future planning. In mediation, you design a maintenance structure that actually makes sense for your family’s specific circumstances.

As your mediator, I cannot provide legal advice about what might happen in your specific case. But I can help you understand your complete financial picture and guide you through creating an agreement that works for both spouses, given your circumstances. With nearly 20 years of experience and specialized training from Harvard, MIT, and Northwestern, I bring the financial expertise and negotiation skills that help couples navigate even the most complex maintenance situations.

The goal is reaching a maintenance agreement that allows both of you to maintain a reasonable standard of living, accounts for post-divorce financial realities, protects what you’ve built, and gives both parties confidence that the deal is fair and sustainable. That kind of agreement is only possible when you’ve done the hard work of gathering information, analyzing the numbers honestly, and choosing mediation over the uncertainty of litigation.