Why pensions are the most complicated asset in divorce

After nearly twenty years of mediating divorces, I can tell you with certainty: pensions are the retirement asset that causes the most confusion, the most disagreement, and the most expensive mistakes. That’s because, unlike a 401(k), where you can see today’s balance on a statement, a pension is a promise of future payments that might not start for years or even decades. You’re trying to divide something you can’t see, touch, or fully understand until it starts paying out.

The valuation methods are complex, the choices about how to divide pensions have huge long-term implications, and if you don’t handle them correctly up front, you’ll be dealing with the consequences for the rest of your retirement years.

Defined benefit plans explained

A pension is what financial professionals call a defined benefit plan. Instead of having an account that you can see growing, your employer promises you a specific monthly payment for the rest of your life once you retire, based on how long you worked there and what you earned.

The formula varies by employer. Some calculate benefits as a percentage of your average salary over your last few years. Others might average your entire career or use your highest three consecutive years. Government pensions often use different formulas than private sector pensions.

What makes pensions particularly valuable and complicated is that they continue paying until you die, and often extend to a surviving spouse afterward. You’re not dividing a pot of money – you’re dividing a stream of income that could last thirty or forty years into retirement.

The marital portion versus the separate portion

Just because someone has a pension doesn’t mean the entire benefit gets divided. You’re only dividing the portion earned during the marriage. Years worked before marriage or after separation represent separate property.

This is where the coverture formula comes in. The formula calculates the marital portion by dividing the years of service during the marriage by the total years of service at retirement.

If your spouse worked for the same employer for thirty years total and you were married for eighteen of those years, the marital portion is 18/30, or 60% of the pension benefits. That’s what gets divided between you. The other 40% stays with the employee spouse.

If the divorce happens before retirement, you’re working with projections. You don’t know for sure how many years they’ll ultimately work or what their final salary will be. That uncertainty is part of what makes pension division so complex.

Two approaches: immediate offset versus deferred distribution

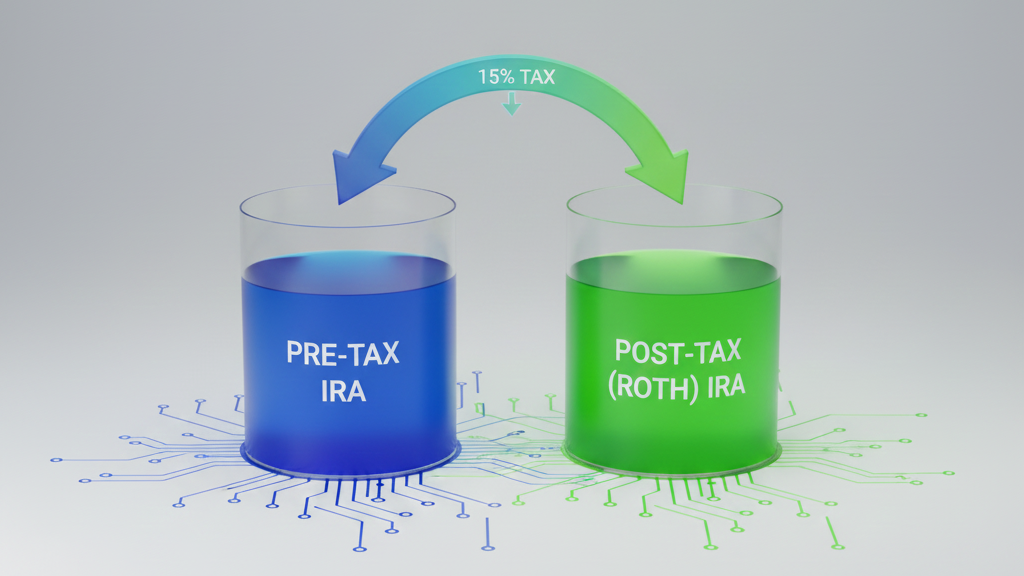

When dividing a pension, you face a fundamental choice. You can calculate the present value of the marital portion and offset it with other assets now – that’s immediate offset – or you can divide the actual pension payments when they start in the future – that’s deferred distribution.

With immediate offset, you determine the marital portion’s value in today’s dollars and take other assets equal to your share. Maybe you’ll get more equity in the house or a larger share of investment accounts like IRAs. You’re done – you get your share now in assets you control. The downside is that present value calculations require assumptions about life expectancy, interest rates, and future payments that might be wrong.

Deferred distribution means you’ll receive a percentage of the pension payments when they start. When your ex-spouse retires, you receive your portion directly from the pension administrator. You’re dividing the actual benefit, not a projection. The downside is you’re tied to their retirement timing and have to wait years for money you might need now.

We help couples think through which approach makes sense for their situation. If the person with the pension is close to retirement, deferred distribution often works better. If retirement is twenty years away and you need assets now, an immediate offset might make sense – if we can agree on a fair valuation.

Valuing a pension requires expertise

When you need to calculate what a pension is worth today, you’re entering the complicated world of actuarial science. The present value depends on the monthly payment amount, start date, recipient’s expected lifespan, and the discount rate.

We can estimate some factors reasonably – the pension formula, projected payments, and life expectancy. But the discount rate is contentious. The higher the rate, the lower the present value. Litigating couples hire competing actuaries who use different assumptions and arrive at valuations that differ by hundreds of thousands of dollars.

In mediation, we can agree on reasonable assumptions or use federally published discount rates, rather than fighting over dueling experts. My MBA in Finance enables me to explain these concepts clearly and help you understand how different assumptions impact valuation. We’re trying to reach a fair agreement based on the best available information, not win an argument about mathematical models.

Survivor benefits and cost-of-living adjustments

Many pensions offer survivor benefits – if the employee spouse dies, the surviving spouse continues receiving a portion of the pension. Your divorce agreement needs to address whether the non-employee spouse retains these survivor benefit rights, or they’re typically lost.

Cost-of-living adjustments matter enormously over time. A pension paying $3,000 monthly with a 2% annual COLA will pay nearly $5,500 monthly after thirty years. Without a COLA, that same $3,000 has lost significant purchasing power to inflation. Government pensions often offer better COLAs than private-sector pensions, which substantially affects their long-term value.

Early retirement and timing protections

What happens if the employee spouse wants to retire early with reduced benefits? Some domestic relations orders specify that the non-employee spouse can start receiving benefits when the employee spouse first becomes eligible to retire, even if the employee spouse doesn’t actually retire then. This protects you from being held hostage to their retirement timing. These terms are negotiable in mediation, and the framework you create will govern this asset for decades to come.

Why mediation works better for pension division

I’ve seen pension cases litigated where each spouse spent $20,000 or more in legal fees and expert witness costs – hiring dueling actuaries, fighting over valuation methodologies, spending months in discovery, only to hand the decision to someone who doesn’t know their financial life.

In mediation, we work collaboratively through these issues. I leverage my MBA and specialized training from the Institute for Divorce Financial Analysis to help you understand the numbers without the expense of competing experts. If you need outside expertise for a particularly complex valuation, we can hire a single neutral expert that both of you can use, avoiding the battle of the experts entirely.

Most importantly, mediation enables creative solutions that litigation cannot accommodate. Perhaps the spouse with the pension could buy out the other spouse’s share by refinancing the house. You might offset the pension against the 401(k) or structure a payment plan tailored to your situation.

Navigating complex pension scenarios

Here’s where deep financial expertise becomes essential. Government employees in California or New Jersey often have CalPERS, CalSTRS, or state pension systems with specific division and survivor benefit rules. Private-sector pensions might include early-retirement subsidies, which could affect valuation. Some pensions allow lump-sum distributions, while others pay only monthly benefits.

Suppose either spouse has multiple pensions from different employers, or both a pension and a 401(k), the complexity multiplies. How do you structure a division accounting for different benefit types, tax treatments, and timelines? These aren’t simple arithmetic problems – they require financial analysis of your complete picture.

We can model different scenarios: What if you take out more home equity and your spouse keeps a larger share of the pension? How does that affect your long-term financial security? What if there are significant age differences affecting life expectancy assumptions? These questions demand someone who understands both the technicalities of pension valuation and how to structure settlements that serve your long-term interests.

Active guidance through difficult decisions

We don’t expect you to understand actuarial science or know the correct answer to the immediate offset versus deferred distribution question. Instead, we actively guide you through each decision point based on your age, financial needs, other assets, and tolerance for remaining connected to your ex-spouse’s retirement decisions.

What if the pension formula includes unusual elements or there are beneficiary designation issues? What if the employee spouse is considering early retirement that would trigger benefit reductions? You’re not navigating these complications alone or hoping you didn’t overlook something critical.

Planning for your long-term security

Dividing pensions isn’t just about splitting what exists today – it’s about ensuring you’re both positioned for financial security decades from now. What if the employee spouse changes careers and stops accruing pension benefits? What if they get laid off before retirement and the pension doesn’t fully vest? What if health issues force early retirement with reduced benefits?

We can’t predict every possibility, but we can build agreements that account for likely scenarios and give you clarity about what happens if circumstances change. This future-focused approach distinguishes mediation from litigation. In mediation, we can build in provisions addressing what happens as life unfolds, creating a framework that provides security and reduces future conflict.

Don’t underestimate pension value

The biggest mistake I see with pensions is treating them as less important than they actually are. Because you can’t see a current account balance the way you can with a 401(k), couples sometimes shortchange pension value in negotiations, focusing on the house and investment accounts while treating the pension as an afterthought.

For someone with twenty-five years at a job with a good pension, that pension might be the most valuable asset in the marital estate – worth more than the house, the 401(k)s, and everything else combined. Giving up your share or accepting a lowball valuation can cost you hundreds of thousands of dollars over the course of your retirement. Take the time to understand what your spouse’s pension is actually worth and make informed decisions.

The choice that determines your retirement security

Your approach to dividing pensions will profoundly impact your financial future. In litigation, you’re handing this critical decision to someone who doesn’t know your situation, hiring expensive experts to fight each other, and ending up with rigid orders that might not serve either of you well.

In mediation, you maintain control over these decisions. You work with someone who has the financial expertise to guide you through the complexity, the negotiation skills to help you reach fair agreements, and the commitment to ensuring both spouses are positioned for long-term security. You’re not fighting over your pension – you’re working cooperatively to protect your retirement future.

The technical aspects of pension division are genuinely complex, but they’re manageable with proper guidance and a cooperative approach. Your retirement security deserves better than courtroom battles and rigid formulas applied by people who don’t know your life. Choose the path that gives you control, flexibility, and confidence about your financial future.