Why your employer retirement plan is worth fighting for – the right way

If you’ve spent years building up your 401(k) or 403(b), the thought of splitting it in divorce probably makes your stomach turn. That account represents decades of saving, countless paycheck deductions, maybe even employer matches that finally vested after you stuck it out through those tough years.

Here’s what I tell couples in my mediation practice after nearly two decades helping people navigate these decisions: dividing employer retirement plans doesn’t have to destroy your financial future, but getting it wrong can cost you tens of thousands of dollars. The difference comes down to understanding how these accounts actually work and having someone with financial training help you structure the division intelligently.

What makes these accounts different from other assets

Your employer retirement plan isn’t like your house or car. You can’t just sign it over or write someone a check for half of it. These accounts are governed by federal law under ERISA – the Employee Retirement Income Security Act – which means they come with strict rules about who can access them and how.

A 401(k) is a standard retirement plan for most private sector employees. Nonprofit employees typically have 403(b) plans, while government and certain nonprofit employees may have 457(b) plans. They all work similarly and require a special court order to divide them in a divorce. That’s where things get interesting, and where many couples make expensive mistakes.

The QDRO: your ticket to splitting the account without penalties

QDRO stands for Qualified Domestic Relations Order – basically a court order that tells the retirement plan administrator to give a portion of one spouse’s account to the other spouse. Without a QDRO, the plan administrator can’t and won’t touch the money, regardless of what your divorce decree says.

I’ve seen couples finalize their divorce, thinking they’d handled everything, only to discover months later that the 401(k) wasn’t actually divided because no QDRO was drafted. Now they’re back in the system, trying to fix it, spending more money, and creating more conflict.

Here’s what the QDRO process looks like. After your divorce agreement specifies how the account will be divided, someone needs to draft a QDRO that translates that agreement into language the plan administrator can follow. This isn’t a DIY project. The order must comply with both federal law and your specific retirement plan’s rules, which can be surprisingly detailed.

Once drafted, the QDRO goes to the plan administrator for pre-approval, then gets submitted for approval, and then back to the plan administrator for implementation. This process typically takes two to six months, even when everything goes smoothly.

Immediate distribution versus keeping the money in the plan

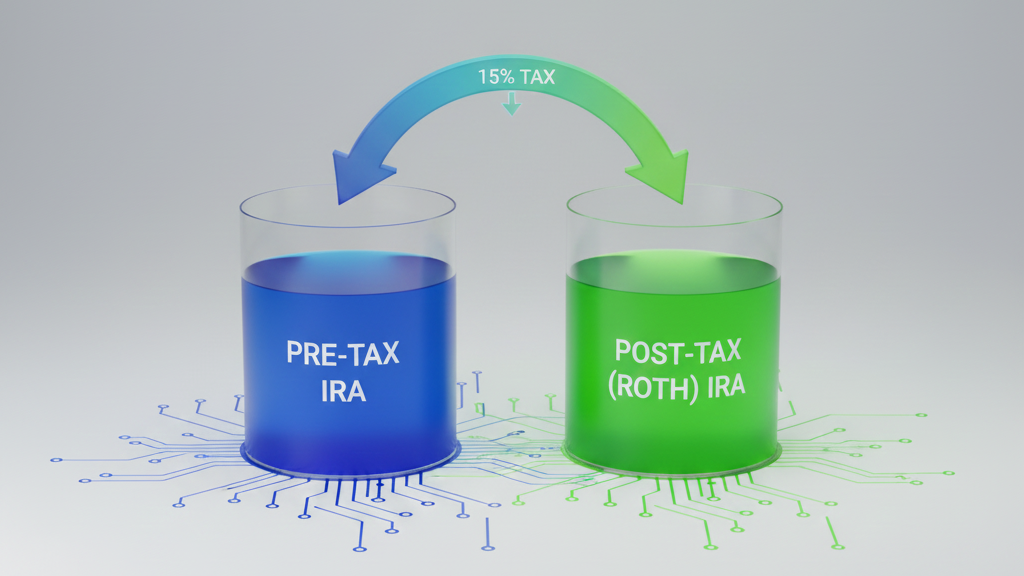

Once the QDRO is approved, the spouse receiving a portion faces a choice: take an immediate distribution of their share, or keep it in the ex-spouse’s plan or roll it into their own IRA.

Taking an immediate distribution has one significant advantage: you get a one-time exception from the 10% early withdrawal penalty that generally applies if you’re under 59½. You’ll still owe income taxes on this pre-tax money, but you avoid the additional 10% penalty.

But here’s the reality. If you withdraw that money now, you’re taking it from a tax-deferred account where it could have continued growing for another twenty or thirty years. You avoid the 10% penalty, but you’re still paying income taxes at your current rate, and you lose all that future growth. It’s not automatically a bad decision, but it needs to be an informed one.

The alternative is to roll it into your own IRA within sixty days. This keeps the money working for your retirement and preserves its tax-deferred status. For most people who can manage without touching these funds, that’s the financially more intelligent choice.

Outstanding loans, vesting, and multiple accounts

If there’s an outstanding loan against the 401(k), you’re really dividing what’s left after accounting for the debt. If the account has $100,000 but there’s a $20,000 loan, you’re dividing $80,000 of actual value. Your divorce agreement should clearly state who’s responsible for repaying the loan.

Not all the money in your 401(k) might actually be yours yet. Employer-matching contributions often come with vesting schedules – you earn full ownership over time, typically over three to six years. You’re dividing the marital portion of the vested balance. If unvested employer contributions won’t vest because someone’s leaving the company, that affects the actual value of what you’re dividing.

If you’ve worked for multiple employers, you may have several 401(k)s or 403(b)s scattered around. Each one needs its own QDRO. You could divide all accounts proportionally, or negotiate a trade in which one spouse keeps all their accounts, and the other gets a larger share of the larger account. In mediation, we can structure it to make sense for your situation.

The mediation advantage for retirement account division

In litigation, you’re handing your financial future to a stranger who doesn’t know your situation and applying rigid formulas that might not serve either of you well. A 50/50 split gets ordered based on some formula, and that’s that – regardless of whether it actually makes sense for your circumstances.

In mediation, we can be strategic. Maybe the 401(k) has great investment options and low fees, making it worth more than its face value. Perhaps one of you needs funds for a down payment on a house and could benefit from the QDRO distribution exception. You might consider trading retirement assets for equity in the home or offsetting your 401(k) against a pension — one of several strategies used when dividing pensions in divorce.

Here’s an example from a New Jersey couple we mediated with: The husband had a $400,000 401(k) with excellent low-cost index funds, while the wife had a $200,000 pension from her teaching career. Rather than splitting both accounts, we structured an agreement under which he kept his entire 401(k), and she kept her full pension. Each walked away with roughly equal retirement value, avoiding the complexity and cost of two QDROs while maintaining control over accounts they knew well.

That kind of creative solution only happens when you’re working cooperatively in mediation. In litigation, you get a formula applied to each account individually, whether that makes sense or not.

Navigating financial complexity in retirement division

This is where having financial expertise in your corner makes an enormous difference. If your compensation includes bonuses, stock options, RSUs, or equity shares that flow into your 401(k), the division becomes more complex. When do you value those assets? How do you account for vesting schedules on equity compensation? What happens if unvested shares vest after the divorce but before the QDRO is executed?

With an MBA in Finance and specialized training from the Institute for Divorce Financial Analysis, I can cut through this complexity. We can model different scenarios: What if you take a larger share of the 401(k) and your spouse takes more home equity? How does that affect your long-term retirement security? What if one of you is planning to relocate to a state with different income tax rates – how does that change the after-tax value of retirement withdrawals?

These aren’t just theoretical questions. The answers directly impact your financial security for decades to come. Getting them right requires someone who understands both the technical aspects of retirement accounts and how to structure settlements that serve your long-term interests.

Working through the process with active guidance

We don’t require you to have everything figured out before coming to mediation. That’s not realistic, and it’s not how we work. Instead, we actively guide you through each decision point, presenting options and helping you understand the implications of each choice.

Should you take the QDRO distribution or roll it over? That depends on your immediate financial needs, your tax situation, your retirement time horizon, and whether you have the discipline to avoid touching money that’s been rolled into an IRA. We’ll work through all of these factors together.

How do you handle a 401(k) loan that’s still outstanding? We’ll look at who’s better positioned to pay it off and structure the division accordingly. If the loan affects the actual value being divided, we’ll account for that in the overall settlement.

What if the plan administrator rejects the first QDRO draft because it doesn’t comply with the plan’s specific rules? This happens more often than you’d think. We’ll work with the QDRO specialist to revise and resubmit until it’s approved. You’re not navigating this alone or hoping you didn’t miss something critical.

Planning beyond the immediate divorce

Dividing retirement accounts isn’t just about splitting what exists today. It’s about ensuring you’re both positioned for financial security in 20 or 30 years. That requires thinking ahead about how changes in circumstances might affect your retirement planning.

What if one spouse remarries and combines households, significantly reducing living expenses? What if health issues arise that require early retirement? What if the job market shifts and someone needs to draw on retirement funds sooner than planned? While we can’t predict the future, we can build agreements that give you flexibility to adapt as life changes.

This future-focused approach sets mediation apart. We’re not just documenting a division of assets – we’re helping you create a financial foundation that gives you confidence moving forward, regardless of what comes next.

The choice between cooperation and conflict

Your employer retirement plan represents years of disciplined saving and sacrifice. It’s probably one of your most valuable assets, and how you divide it in divorce will significantly impact your financial security for the rest of your life.

In litigation, you lose control of that decision. Someone who doesn’t know your financial life applies rigid rules and hands down orders. The process is expensive, drawn-out, and often leaves both spouses feeling frustrated with the outcome.

In mediation, you maintain control. You make informed decisions with expert guidance, structure arrangements that actually work for your situation, and preserve the resources you’ve worked so hard to build. You’re not fighting over your retirement accounts – you’re working together to protect them.

The technical aspects of dividing 401(k)s, 403(b)s, and 457 plans are complex, but they’re not mysterious. With proper guidance and a cooperative approach, you can structure a division that protects both of your retirement futures without years of conflict or devastating legal bills. Your financial security is too important to leave to chance or to rigid court formulas that don’t account for your real life.