When you’re facing divorce, the word “alimony” can trigger a lot of anxiety. Perhaps you’ve heard a friend mention paying “permanent alimony” for decades. Or maybe you’re concerned about supporting yourself after being out of the workforce for years.

Here’s some good news: New Jersey actually changed its entire approach to spousal support back in 2014, and those changes make the system much fairer and more predictable than what you might have heard about from older divorces.

As a divorce mediator with a finance background, I walk couples through these distinctions every day. And while I can’t give you legal advice, I can help you understand how New Jersey’s alimony system works and what it means for your specific situation.

Please note: The financial examples in this post are for illustration purposes only and use simplified scenarios with round numbers to demonstrate concepts. Every divorce situation is unique, with different income levels, expenses, family circumstances, and financial complexities. These examples are not predictions of what you should expect in your specific case. I’m not a lawyer and cannot provide legal advice or tell you what alimony amount you’ll receive or pay.

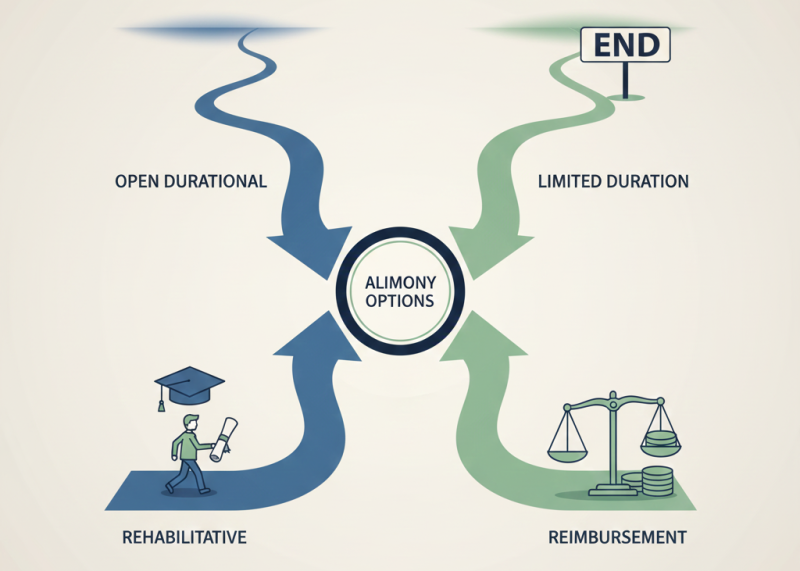

The Four Types of Alimony You Should Know About

Think of New Jersey’s alimony system as having four different tools in the toolbox. Each one is designed for a different situation, and understanding which one applies to you can help take some of the mystery out of the process.

Open Durational Alimony

This is the type that used to be called “permanent alimony,” but the name change actually matters. Open durational alimony doesn’t have a specific end date when you finalize your divorce. However, you can still seek modification or termination when circumstances change significantly—such as retirement, remarriage, or significant shifts in either person’s financial situation.

This type typically applies to marriages lasting 20 years or more. From a financial planning perspective, I help couples envision their future, considering what their lives might look like 10, 15, or 20 years from now. How does alimony fit with retirement plans? When does Social Security kick in? These long-term projections help both people feel more confident about the path forward.

For instance, if you’re 55 now and planning to retire at 67, we might model alimony payments of $3,000 monthly for the next 12 years, then explore how a gradual step-down could work as retirement approaches. This prevents the shock of support dropping to zero overnight and helps both people realistically plan their financial futures.

Limited Duration Alimony

This type provides support for a specific period of time that you determine when you finalize your divorce. For marriages under 20 years, limited-duration alimony in New Jersey typically can’t last longer than the marriage itself, unless there are exceptional circumstances.

So if you were married for 12 years, you’re generally looking at alimony lasting no more than 12 years. This creates a clear finish line that both people can see and plan for. If you’re receiving alimony, you know how long you have to build up your own income. If you’re paying, you can prepare financially for when that obligation ends.

Let’s say one spouse earns $100,000 and the other earns $40,000 after a 15-year marriage. We might structure limited-duration alimony of $2,000 per month for 12-15 years, giving the lower-earning spouse time to increase their income while the higher earner can see a definite endpoint.

Rehabilitative Alimony

This type has a specific goal: helping a spouse get back on their feet financially by gaining education, training, or work experience. Perhaps you’ve paused your career to raise children and now need to update your skills, or you’re looking to complete a degree you began years ago.

What I really like about rehabilitative alimony in mediation is that you can create a concrete plan together. You’re outlining specific steps: “I’m enrolling in this certification program, it takes 18 months, and here’s what my earning potential looks like when I complete it.” This creates clarity for both parties, enabling the recipient to achieve financial security and make real progress.

For example, suppose you need to complete a nursing degree that costs $20,000 and takes 2 years. In that case, we can structure rehabilitative alimony of $2,500 per month for 24 months to cover both tuition and living expenses during that focused period.

Reimbursement Alimony

This one’s less ordinary but necessary when it applies. Reimbursement alimony addresses situations where one spouse supported the other through medical school, law school, or another advanced degree, expecting to benefit from that increased earning power later. If the marriage ends before that benefit materializes, reimbursement alimony compensates the supporting spouse for their investment.

The financial analysis here gets detailed—we’re calculating not just the tuition you paid, but also the opportunities you gave up along the way.

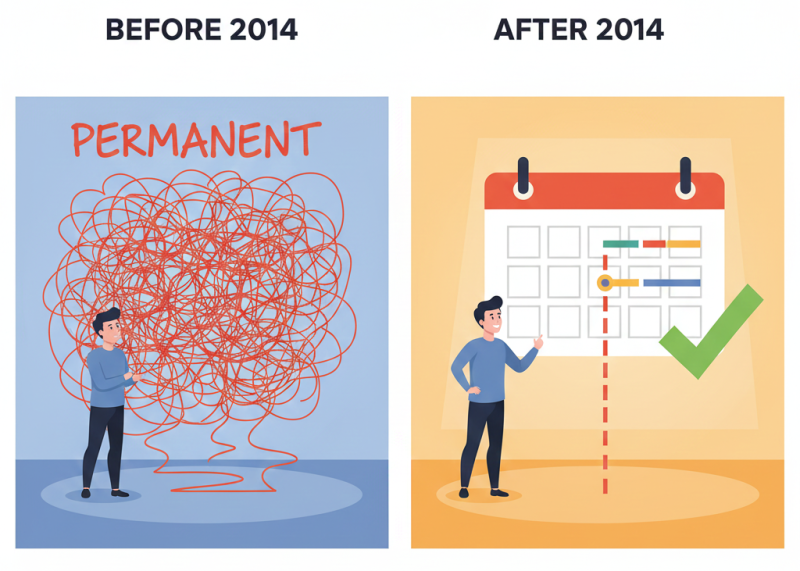

What Changed in 2014 (And Why It Matters to You)

New Jersey’s 2014 reform fundamentally shifted how alimony works, affecting real people’s lives. If you’re getting divorced now, you’re operating under a much more balanced system than existed before, in my opinion.

“Permanent Alimony” Is Gone

The most significant change was eliminating the term “permanent alimony” and replacing it with “open durational alimony.” Under the old system, the term “permanent” created the expectation that alimony would last forever, leading to considerable bitterness and conflict. The payor felt trapped indefinitely. The recipient felt entitled to lifetime support.

The new terminology acknowledges reality: circumstances change over time. People retire. Life evolves. This shift helps couples in mediation have more grounded discussions about duration without getting stuck in all-or-nothing thinking.

Clear Guidelines for Marriage Length

For marriages under 20 years, limited-duration alimony typically can’t exceed the length of the marriage unless there are exceptional circumstances. Before 2014, if you went to court, you faced judges with much broader discretion, making outcomes feel arbitrary and stressful. That unpredictability made it harder for couples to feel confident about their futures.

Now, if you were married for 14 years, you generally know you’re looking at a maximum 14-year alimony period. In mediation, we use this as a starting point, though you’re always free to negotiate something that better suits your situation.

Retirement Actually Matters Now

In New Jersey, now, reaching full retirement age (as defined by Social Security – currently 67 for most people) creates a valid reason to modify or end alimony. Most people struggle to afford the same alimony payments once they’re living on a fixed retirement income.

In mediation, we can build this reality into your agreement from the start. Perhaps alimony should be phased out gradually as the payor approaches retirement age, or we should ensure the recipient has sufficient retirement assets to offset the potential termination of support. We can model different scenarios: What if alimony drops from $3,000 to $2,000 at age 62, then to $1,000 at age 65, and ends at 67? This prevents financial shocks and gives both people clear expectations.

How Understanding This Framework Helps You in Mediation

When you walk into mediation with a basic understanding of how New Jersey’s alimony system works, something shifts. Instead of feeling like you’re stumbling through the dark, you can have informed conversations about what actually makes sense for your situation.

I’ve seen it happen countless times. A couple comes in anxious and adversarial about alimony. But once we break down the four types and discuss how New Jersey handles them, they can step back from fighting and start problem-solving.

Using my finance background, I can help you model different scenarios. What does your budget look like with $2,500 monthly in alimony versus $3,500? What if we do without alimony entirely, but adjust the asset division so you keep the house with an additional $200,000 in equity? How do taxes factor in? What happens when the recipient’s income increases from $40,000 to $70,000 or when the payor retires?

The 2014 reform made mediation even more effective by providing clearer frameworks to work within, while still preserving your freedom to negotiate something that fits your specific needs.

Creating Your Path Forward with Confidence

Divorce is hard. The financial uncertainty makes it even harder. But understanding the four types of alimony and how New Jersey’s system actually works can help transform that free-floating anxiety into concrete discussions about real numbers and realistic timelines.

Whether your marriage lasted 9 years or 25 years. Whether you’re worried about paying or worried about having enough to live on. Knowing these distinctions helps you ask better questions, evaluate proposals more thoughtfully, and make decisions you can feel confident about.

Mediation gives you something litigation never can: control over your own outcome. In court, you’re hoping a judge who doesn’t know your family makes the right call about your financial future. In mediation, you’re designing solutions that actually work for your situation.

This is especially true when finances get complicated—when you’re dealing with multiple types of income, retirement planning, career transitions, or complex assets. With an MBA in finance and nearly 20 years of mediation experience, we can clear through that complexity and help you see a path forward. We don’t just address the immediate alimony question—we help you anticipate how your agreement will work five, ten, or twenty years from now. What happens when you retire? When your youngest finishes college? When circumstances change?

That future-focused planning makes all the difference. You’re not just getting through your divorce. You’re setting yourself up for financial security and peace of mind in the years ahead.

If you’re facing these questions about alimony in New Jersey, consider mediation with someone who combines financial expertise with deep mediation experience. You deserve an approach that turns anxiety into clarity and helps both of you move forward with confidence.