You’d think answering the question “What’s your income?” would be straightforward. And for some people, it is—you work a salaried job, you get a W-2, done.

But for many couples I work with in mediation, determining “income” for spousal support purposes becomes surprisingly complex. And getting it right matters enormously, because every dollar we count or don’t count affects the support calculation.

California takes a broad view of what constitutes income for spousal support purposes. The basic principle is this: if money is flowing to you from any source, it likely counts as income. But the devil, as they say, is in the details.

Let me walk you through what counts, what doesn’t, and why having a mediator with financial expertise like me makes a real difference as you work through these questions.

The straightforward stuff: wages and salary

If you’re a W-2 employee earning a regular salary or hourly wage, this part is easy. Your gross income from employment counts. That’s your income before taxes and deductions, not your take-home pay.

But even here, we need to be careful. Are you receiving fairly consistent overtime? That should probably be included in your regular income. Do you work seasonal hours that vary significantly throughout the year? We need to calculate an average. Did you get a raise or a promotion? We need to use your current earning level, not what you made last year.

In mediation, we look at your recent pay stubs to get an accurate picture of your current earnings. We’re not trying to lowball or inflate the numbers—we’re trying to establish what you’re actually earning right now, because that’s what matters for calculating fair California spousal support.

Bonuses and commissions get complicated.

This is where things start getting interesting. If you receive annual bonuses or earn commissions, do those count as income for support purposes? The answer in California is usually yes, but with nuance.

If you receive a consistent annual bonus—say, your company gives everyone a 10% year-end bonus and has done so for the past five years—that’s clearly income we should factor in. But what if your bonus varies wildly from year to year based on company performance? What if you work on commission and your income swings dramatically month to month?

In these situations, we typically look at historical averages over the past few years. Suppose your bonuses have averaged $20,000 annually over the past three years. In that case, that’s probably a reasonable amount to include in your income calculation, even if any single year might be higher or lower.

This is where my MBA comes in handy. I help couples analyze compensation structures, look at trends, and determine what’s a realistic and fair number to use for variable income. We’re not just plugging numbers into a formula—we’re doing financial analysis to get an accurate picture.

Stock options, RSUs, and equity compensation

Welcome to the 21st century, where increasingly people receive significant portions of their compensation in forms other than cash. Stock options, restricted stock units (RSUs), employee stock purchase plans, and other forms of equity compensation are common, especially in California’s tech-heavy economy.

California generally considers these forms of compensation as income when they vest or when you exercise them. If you’re receiving RSUs that vest quarterly, each vesting event is an income event for support purposes. If you exercise stock options and realize a gain, that gain is income.

But the timing matters. Stock that hasn’t vested yet isn’t income today. Underwater options (i.e., the strike price is above the current stock price) have no current value. We need to look carefully at vesting schedules, stock prices, and actual realizable value.

In mediation, I work with couples to understand these equity compensation packages and determine what’s fair to count as income. Sometimes we use historical averages of vested equity. Sometimes we project future vesting based on current stock prices. The key is that both spouses understand what we’re including and why.

Self-employment and business income

If one or both of you own a business or are self-employed, calculating income becomes significantly more complex. Your business tax returns might show a profit or loss, but that doesn’t necessarily reflect your actual income available for support purposes.

Why? Business owners often structure their finances to minimize taxable income. You might take legitimate business deductions that reduce your reported income but don’t actually reduce your standard of living. Company cars, business meals, home office deductions, depreciation – these all reduce your taxable income but don’t reduce the money available to you.

California law looks at your real economic benefit from business ownership, not just what shows up on your tax return for alimony. We need to sift through your business returns and “add back” certain expenses that are really personal benefits. This requires sophisticated financial analysis—precisely the kind of work my financial background prepares me to do.

In mediation, we review business statements such as Income Statements and Profit & Loss Statements together, line by line if necessary, to understand your real income. This isn’t about catching someone hiding money (though we’ll address that too). It’s about accurately determining economic reality.

Rental income and investment returns

If you own rental property, the rental income generally counts as income. But we need to distinguish between gross rents and net rental income after legitimate expenses, such as mortgage payments, property taxes, insurance, and maintenance.

Investment income—interest, dividends, and capital gains—typically counts as income for support purposes. If you have a portfolio generating $30,000 in dividends and interest annually, that’s income we need to factor in.

One wrinkle: what about investments in retirement accounts that are growing but you’re not taking distributions? Generally, the growth inside retirement accounts doesn’t count as current income. But once you start taking distributions from retirement accounts, those distributions are income.

In mediation, we look at all your income-producing assets and determine which are actually generating cash flow and should be counted. A $500,000 retirement account isn’t income. But a $500,000 investment account generating $25,000 in annual dividends is.

Retirement and pension income

If you’re receiving Social Security benefits, pension payments, or distributions from retirement accounts, these count as income. Even though you might think of them as “just getting back what you put in,” California treats them as current income available for support purposes.

This becomes especially relevant in gray divorces involving older couples where one or both spouses are retired or nearing retirement. Your retirement income is income, plain and simple.

Unemployment and disability benefits

Unemployment insurance benefits count as income. Disability insurance payments generally count as income. Workers’ compensation benefits can count as income. Public assistance like welfare generally doesn’t count, but most other government benefits do.

The reasoning is straightforward: these are dollars coming to you that you can use to meet your expenses, so they’re relevant to determining how much support you need or can pay.

What doesn’t count as income?

Some things explicitly don’t count as income for support purposes. Child support you receive for your kids isn’t income – that money is meant for your children, not for you. Gifts from family members aren’t income (though if you’re receiving consistent “gifts” that are really disguised support, we need to look at that carefully). Loans aren’t income. Money you’re withdrawing from your own savings isn’t income – it’s just moving your own money around.

The distinction matters because people sometimes try to inflate or deflate income by pointing to money movement that isn’t really income at all.

The critical importance of full disclosure

I cannot overstate how important it is that both spouses provide complete and accurate information about all income sources. In mediation, we work on trust and good faith. If you’re hiding income or failing to disclose your income sources, you’re not just being dishonest with your spouse—you’re undermining the entire mediation process.

California requires full financial disclosure in divorce. You’ll need to complete income and expense declarations that detail all your income sources. These aren’t suggestions—they’re requirements. And they need to be accurate.

In my practice, I help couples gather and organize this information. We look at tax returns, pay stubs, bank statements, brokerage statements, and business records. We make sure we’re capturing the complete picture. This isn’t about being adversarial—it’s about making sure both spouses have the information they need to negotiate fairly.

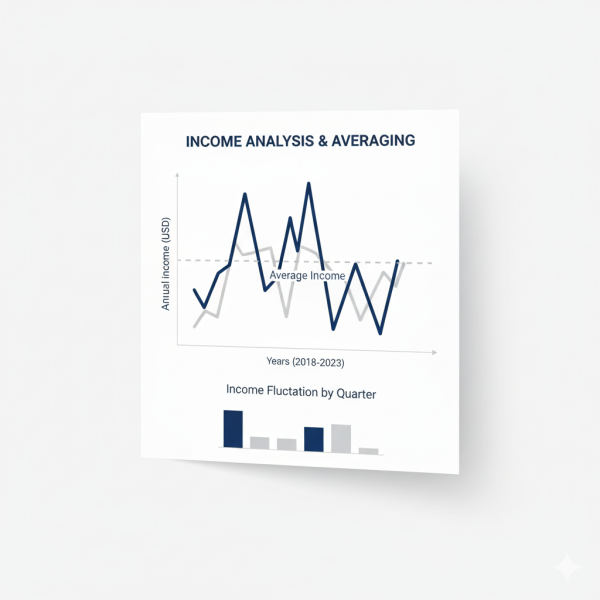

Handling income that varies dramatically

Some couples face the challenge of income that varies dramatically from month to month or year to year. Maybe one spouse is a salesperson whose commissions swing wildly. Maybe you’re in an industry with seasonal work. Maybe you’re self-employed and your income is simply unpredictable.

In these situations, we typically look at multi-year averages to smooth out the volatility. If your income was $80,000 one year, $120,000 the next, and $100,000 the year after, we might use $100,000 as your income for support purposes. We’re trying to find a number that’s representative of your actual earning pattern, not the outlier high year or the outlier low year.

In mediation, we can also structure support arrangements that account for income variability. Maybe support is calculated as a percentage of actual income rather than a fixed dollar amount. Maybe we can build in review periods to adjust support as income circumstances change. These flexible approaches are much harder to achieve in litigation but work beautifully in mediation.

Why getting income right matters so much

Every dollar we count as income affects the support calculation. If we understate your income by $10,000, the support amount will be off. If we overstate it by $10,000, the support amount will be off in the other direction. And we’re not just talking about slight differences—depending on the formula and circumstances, a $10,000 income error might translate into several hundred dollars per month in miscalculated support.

Getting the income numbers right is foundational to reaching a fair support agreement. This is where having a mediator with an MBA in Finance, like me, provides real value. I can help you analyze complex compensation structures, understand what counts — and what doesn’t —and arrive at accurate income figures that both spouses can trust.

Your income picture should be clear, not murky.

Determining what income counts for spousal support purposes isn’t about playing games or manipulating numbers. It’s about establishing an accurate, honest picture of each spouse’s financial resources. When we get the income calculation right, everything that follows—the support amount, the duration, the overall settlement—rests on a solid foundation.

In mediation, we work through these income questions together in a transparent, good-faith manner. You both deserve to understand where the numbers come from and why they matter. And you both deserve a support calculation based on reality, not guesswork or gamesmanship.