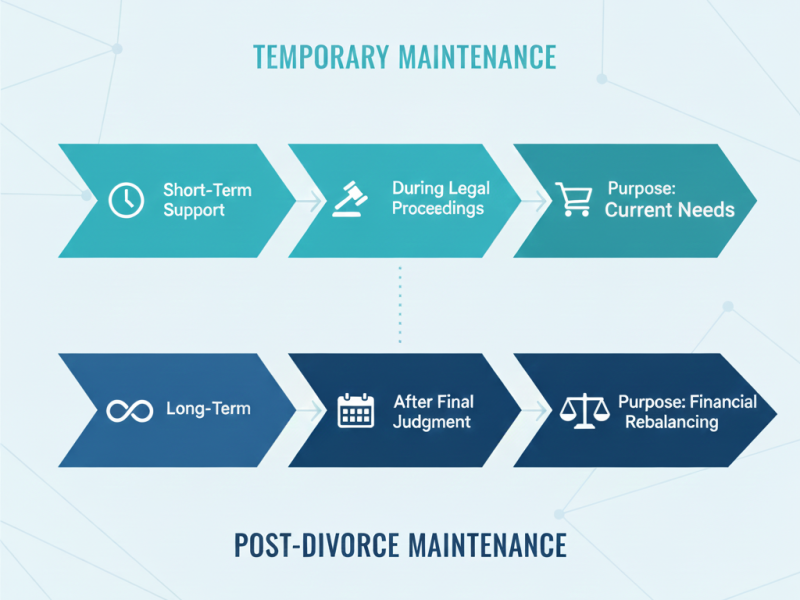

If you’re starting the divorce process in New York and maintenance might be part of your picture, here’s something that catches many people off guard: temporary maintenance and post-divorce maintenance are two completely separate phases. Receiving support during your divorce doesn’t automatically mean you’ll receive it afterward. Understanding this distinction is key to making wise financial decisions. More importantly, understanding how to structure both phases strategically is where mediation gives you a massive advantage over litigation.

Two Phases, Two Different Purposes

Temporary maintenance is your financial lifeline during the divorce itself, while post-divorce maintenance is about your transition to self-sufficiency afterward. Even though New York uses similar formulas, they serve fundamentally different purposes.

Temporary maintenance maintains the status quo while your divorce is pending. If you’ve been financially dependent or earning significantly less, this support helps cover living expenses and legal costs during what might be several months of negotiations.

Post-divorce maintenance is forward-looking, designed to help the lower-earning spouse transition to financial independence. It’s not meant to replace your spouse’s income forever, but to give you time and resources to rebuild your financial life.

In litigation, these two phases often get treated as entirely separate battles. In mediation, we design both phases as a cohesive plan that gets you from where you are now to financial independence.

The Formulas: Starting Points, Not Final Answers

New York uses statutory formulas for both types of maintenance. As of 2025, calculations cap income at $228,000. The formula varies depending on whether child support is being paid.

The formula is just a starting point. For temporary maintenance, the guidelines tend to be applied fairly mechanically. For post-divorce maintenance, there’s more room for thoughtful structuring because you’re looking at long-term realities.

Just because you’re receiving temporary maintenance doesn’t mean that same amount continues afterward. During a divorce, temporary support might be higher to manage legal fees. Afterward, when those costs disappear, and you’ve adjusted, a different structure might make more sense.

In litigation, this transition happens without strategic planning—a temporary amount is set, then months later, you’re fighting over what comes next. In mediation, we plan both phases from the start, creating a complete financial roadmap.

Duration Guidelines and Creating a Glide Path

For post-divorce maintenance, New York provides advisory guidelines on the duration of maintenance. For marriages up to 15 years, maintenance typically lasts 15% to 30% of the marriage length. For fifteen to twenty years, it’s 30% to 40%. For over twenty years, it’s 35% to 50%.

A ten-year marriage might result in maintenance lasting 18 months to 3 years. That’s a wide window. This flexibility is where the “glide path to independence” takes shape—you want enough time to rebuild your financial foundation without creating a cliff where support suddenly stops.

The Power of Step-Down Provisions

This is where financial expertise really matters in mediation. Rather than having maintenance at one level for the entire duration, then dropping to zero, many couples benefit from a step-down approach that gradually reduces maintenance over time.

For example, $3,000 per month for the first year might step down to $2,000 for the second year, then to $1,000 for the third year. This creates a realistic transition rather than a financial shock, and it can be coordinated with your specific situation. Maybe you’re completing an 18-month certification program. Or perhaps you have a child entering school full-time in two years, freeing you up for full-time employment. A step-down structure can mirror these life changes.

These creative structures rarely emerge in litigation. You’re typically fighting over a single amount for a single duration rather than designing a strategic glide path. In mediation, we model different step-down scenarios together, looking at how each structure affects both spouses’ cash flow over time.

Coordinating Maintenance with Career Re-Entry Plans

New York recognizes rehabilitative maintenance—support designed to help you gain the education, training, or work experience needed to become self-supporting. This is particularly relevant if you stepped away from your career during the marriage.

When structuring a financial bridge in mediation, rehabilitative considerations are crucial. If you need to go back to school, update your credentials, or re-enter a field you left years ago, your maintenance agreement should account for that reality. This isn’t just about covering living expenses—it’s about investing in your earning capacity.

If you’re planning a two-year graduate program, you’ll need higher maintenance during those years when you can’t work full-time, then potentially a step-down once you’ve completed the program. The maintenance structure should align with your actual path back to financial independence, not an abstract timeline.

This planning gets lost in litigation. You’re arguing positions rather than designing solutions. In mediation, we actively help you think through your career re-entry strategy and the structure you need to support it.

Modeling Cash Flow for Both Phases

Before negotiating a maintenance agreement that works, understand your cash flow needs during both phases. Create a realistic budget accounting for your actual post-separation expenses.

During temporary maintenance, costs might include legal fees, duplicate housing, and transitional expenses. Post-divorce needs might look different—lower in some categories, higher in others.

Model multiple scenarios. Year one budget? Year two, when your youngest starts school? Year three, when your car lease ends? These aren’t abstract questions—they’re the foundation for structuring maintenance that actually works.

Don’t forget tax implications. For agreements executed after December 31, 2018, maintenance is neither tax-deductible for the payor nor taxable income for the recipient.

With an MBA in finance, we help you run these numbers correctly. We build detailed cash flow models that show you exactly what your financial situation looks like under different maintenance structures. That level of financial analysis allows you to make truly informed decisions.

Strategic Planning You Won’t Get in Litigation

In mediation, you have tremendous flexibility to structure spousal maintenance in creative ways. Unlike litigation, where rigid formulas are applied, mediated agreements can be tailored to your circumstances.

You can build in review points, tie adjustments to specific milestones, such as completing a degree or children reaching certain ages, and structure different amounts for temporary versus post-divorce phases, with clear reasoning for each.

The conversation shifts from “what am I entitled to?” to “what do I actually need, and what’s realistic for both of us?” This results in agreements that both spouses feel are fair and that hold up over time.

In litigation, you’re fighting over temporary maintenance in one hearing, then coming back months later to fight over post-divorce maintenance. There’s no strategic coordination, no thoughtful planning about how these phases work together.

Thinking About the Transition Point

The moment when temporary maintenance ends and post-divorce maintenance begins (or doesn’t) is a critical inflection point. Some couples find that post-divorce maintenance should be lower than temporary maintenance, since legal expenses have ended and both parties have adjusted. Others discover post-divorce maintenance needs are higher because the recipient spouse is investing in education or career retraining.

The key is recognizing these are two separate determinations, even though they’re related. Your temporary maintenance might be set to maintain stability during the divorce, while your post-divorce maintenance might be structured as a decreasing payment over time.

We don’t leave you to figure out this transition on your own. We actively guide you through analyzing what makes sense at each phase, presenting options, and helping you understand the financial implications. That personalized guidance gives you the tools to design a maintenance structure that genuinely works.

Building a Bridge That Actually Supports Both Spouses

The best maintenance structure provides genuine support during transition while remaining sustainable for the paying spouse. If payments are too high or too low, the agreement creates ongoing conflict.

We help couples look at both sides. What can you realistically afford? What do you realistically need? How do we bridge that gap?

Understanding that temporary and post-divorce maintenance are two distinct phases is the first step. Structuring them thoughtfully transforms maintenance from a source of conflict into a genuine bridge to your new life.

In litigation, you’re gambling that someone else will design this bridge properly. In mediation, you maintain control. You’re the architects of your own financial future, working with expert guidance to create solutions that reflect your actual circumstances.

Litigation imposes solutions; mediation empowers you to design them. When it comes to the financial bridge supporting you through and after divorce, having control over that design makes all the difference.

FAQs About Spousal Maintenance in New York

The Mediation Advantage for Maintenance Discussions

Throughout these FAQs, you’ve seen references to mediation as an alternative to litigation. In litigation, attorneys fight over what guidelines produce and argue about how factors apply. You’re spending tens of thousands on adversarial processes that often produce outcomes neither party accepts. For co-parents, this poisons the relationship foundation you need for years ahead.

In mediation, you’re working together to understand what the guidelines say, whether they fit your circumstances, and what alternatives might work better. When you combine that collaborative process with genuine financial expertise—the ability to model scenarios, calculate present values, analyze tax impacts, and structure creative solutions—you get agreements that are both fair and sustainable.

That’s what makes the difference between maintenance arrangements that work and ones that create ongoing conflict.