One of the most important things to understand about New York’s maintenance guidelines is this: they’re presumptive, not mandatory. You and your spouse can agree to something completely different—more, less, or no maintenance.

This flexibility is one of the strongest arguments for mediation over litigation. In court, judges generally follow the guidelines unless there’s a compelling reason to deviate. In mediation, you have the freedom to craft agreements that actually match your circumstances rather than forcing your situation into a formula designed for the average case.

But opting out comes with essential requirements. Your agreement needs to be “fair and reasonable at the time of the making of the agreement” and “not unconscionable at the time of entry of final judgment.” Understanding when to opt out and how to structure these agreements properly is exactly where active guidance from someone with both mediation skills and financial expertise makes all the difference.

Understanding What You’re Opting Out Of

Before deciding whether to deviate from the guidelines, know what they would produce. The best practice is to calculate the presumptive guideline amount before discussing alternatives.

The guidelines use income-based formulas (capped at $228,000 as of 2025) and provide advisory duration schedules. For marriages up to 15 years, maintenance typically lasts 15-30% of the marriage length. For 15-20 years, it’s 30-40%. For over 20 years, it’s been 35-50%.

Knowing these numbers gives you a baseline. You need to understand what you’re agreeing to compared to what a guideline calculation would produce. This prevents someone from later claiming they didn’t understand what they were giving up or accepting.

When Opting Out Makes Strategic Sense

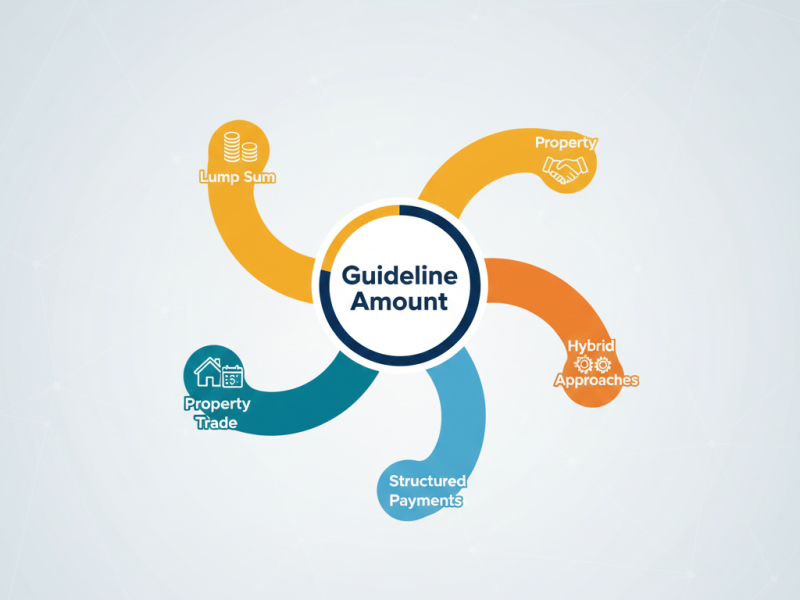

There are several situations where deviating from the guidelines serves both parties better than sticking to the formula.

The most common scenario is when the formula produces results that don’t match your actual circumstances. Maybe the guideline amount is too high, given other aspects of your agreement, if the receiving spouse is getting substantially more property. Or perhaps it’s too low, given special circumstances the formula doesn’t account for.

Property trade-offs often make sense. If the paying spouse strongly prefers finality and the receiving spouse needs capital for a home down payment or business investment, trading a larger property share for reduced or waived maintenance can benefit both parties.

Tax considerations can also justify deviation. While maintenance is no longer deductible or taxable under federal law, there may be other tax planning opportunities that suggest different structures.

Lump-sum arrangements are another area where opting out makes sense. Some couples prefer a single payment rather than ongoing monthly obligations.

In litigation, presenting these creative alternatives becomes extraordinarily difficult. You’re locked into arguing within the guidelines framework unless you can convince a judge there’s a compelling reason to deviate. In mediation, these alternatives emerge naturally.

When the Guidelines Should Probably Apply

Just because you can opt out doesn’t mean you should. The guidelines exist for good reasons—they reflect considered judgment about what’s typically fair.

You should generally stick close to the guidelines when there’s a significant power imbalance. If one spouse has substantially more financial sophistication, better access to information, or greater leverage, the guidelines provide protection.

Cases with substantial ongoing income disparity are another area where the guidelines typically make sense. If one spouse earns $200,000 and the other $40,000, with limited prospects for significant income growth, waiving or dramatically reducing maintenance without clear offsetting benefits risks that the agreement will not be enforceable.

The Legal Requirements: Fair and Reasonable, Not Unconscionable

New York sets standards for opt-out agreements. They must be in writing, signed by both parties, and notarized. Beyond these formalities, the terms must be “fair and reasonable at the time of the making of the agreement and are not unconscionable at the time of entry of final judgment.”

This two-part test is essential. An agreement can be fair when you sign it, but it can become unconscionable by the time you’re finalizing the divorce if circumstances change dramatically.

What is considered “fair and reasonable”? Full financial disclosure, whether both parties understood what they were agreeing to, whether the terms reflect a reasonable balancing of needs and resources, and whether anyone was under duress all come into play. This is where having someone actively guide you through the analysis matters.

Structuring Opt-Out Agreements Properly

When you decide to deviate from the guidelines, documenting your reasoning is crucial. Your agreement should explicitly state that you know the guideline amount, understand you can opt out by agreement, and have chosen to structure maintenance differently for specific reasons.

Spell out those reasons. If you’re trading property for maintenance, document the present value calculations and assumptions. If you’re waiving maintenance in exchange for other valuable consideration, clearly identify it.

This documentation requires financial sophistication. If you’re doing a property-for-maintenance trade, someone needs to accurately calculate the present value, consider tax implications, assess liquidity needs, and ensure the trade makes financial sense. With an MBA in finance, we can guide you through these calculations rigorously.

Include clear termination events. Consider review or modification provisions if there’s uncertainty. Build in protections if the paying spouse agrees to higher-than-guideline maintenance, or if the receiving spouse accepts less based on projected future income.

Why Active Guidance Through This Complexity Matters

In mediation, opt-out discussions occur in a problem-solving environment rather than an adversarial one. You can openly discuss what the guidelines would produce, whether those results make sense for your situation, and what alternatives might work better.

We help couples think through the decision to deviate from guidelines using a structured framework. We start by calculating the presumptive guideline amount to set a baseline. Then we explore whether there are reasons the guidelines might not fit your circumstances. We discuss alternative options that might work better and model the financial implications. Finally, we document the reasoning clearly in your agreement.

This isn’t passive facilitation—it’s active guidance through complex decision-making. We don’t just listen while you debate whether to opt out. We bring options to the table, help you understand the implications of different choices, run the financial calculations that support informed decisions, and ensure your reasoning is adequately documented.

The key is transparency. Both parties need to understand the guidelines, why you’re choosing something different, and the consequences. Many mediators can have that conversation, but few have the financial training to help you model different scenarios accurately or the experience to ensure your opt-out agreement will actually hold up.

Getting the Agreement Right

The goal isn’t to game the system or squeeze every advantage. It’s to reach an agreement that’s genuinely fair to both of you and serves your actual needs better than a formulaic approach would. Sometimes that means following the guidelines closely. Other times, it means creative alternatives that the guidelines never contemplated.

Before finalizing any opt-out agreement, ask yourself: If I had to explain this agreement to a judge five years from now, could I articulate why it was fair when we made it? If circumstances changed and someone wanted to modify it, would the original reasoning still make sense?

These aren’t just hypothetical questions. Agreements that work are agreements both parties can live with as circumstances evolve. The flexibility to opt out of guidelines is valuable, but it comes with the responsibility to use that flexibility fairly.

In litigation, you don’t get this kind of strategic flexibility. You’re either accepting what the guidelines produce or fighting an uphill battle to convince a judge to deviate. You’re spending tens of thousands on attorneys to argue positions rather than collaborating on solutions.

In mediation, we work through these questions together. The result is agreements that reflect your actual priorities and circumstances rather than forcing your complex situation into a simple formula. When you combine that collaborative process with genuine financial expertise and active guidance through the complexity, you get agreements that are both creative and sound—agreements that serve your interests while meeting the legal standards for fairness.

That’s what makes the difference between an opt-out agreement that works and one that creates problems down the road. The freedom to negotiate around the guidelines is powerful, but only when exercised with proper guidance, rigorous analysis, and precise documentation. That’s precisely what mediation with financial expertise delivers.

FAQs About Spousal Maintenance in New York

The Mediation Advantage for Maintenance Discussions

Throughout these FAQs, you’ve seen references to mediation as an alternative to litigation. In litigation, attorneys fight over what guidelines produce and argue about how factors apply. You’re spending tens of thousands on adversarial processes that often produce outcomes neither party accepts. For co-parents, this poisons the relationship foundation you need for years ahead.

In mediation, you’re working together to understand what the guidelines say, whether they fit your circumstances, and what alternatives might work better. When you combine that collaborative process with genuine financial expertise—the ability to model scenarios, calculate present values, analyze tax impacts, and structure creative solutions—you get agreements that are both fair and sustainable.

That’s what makes the difference between maintenance arrangements that work and ones that create ongoing conflict.