Suppose you’re trying to understand New York’s spousal maintenance formula. In that case, you’re probably staring at a combination of percentages and income caps, wondering how they translate into real dollars in your situation. You’re not alone in finding this confusing. The formula itself isn’t particularly complex mathematically, but the way it works produces results that can feel counterintuitive until you understand the financial logic behind it.

Let me walk you through how this actually works, why New York uses two different formulas, and what the current income thresholds mean for your financial planning. More importantly, I’ll show you why understanding these mechanics matters so much more in mediation, where you maintain control over the outcome, than in litigation, where you’re stuck with whatever the formula spits out.

The Two-Formula System: Which One Applies to You?

New York doesn’t use a one-size-fits-all approach to spousal maintenance. Instead, the state uses two different formulas depending on your specific situation, and which formula applies makes a meaningful difference in the outcome.

The Lower Formula (20%/25%) applies when child support is involved, and the person paying maintenance is also the non-custodial parent. This is the most common scenario when you have children and one parent has primary custody.

The Higher Formula (30%/20%) applies in two situations: when there are no children requiring support, or when the person paying maintenance is actually the custodial parent. This second scenario surprises people, but it makes sense when you think about it. If you’re already shouldering the day-to-day expenses of raising the children, the formula recognizes you have less income available for maintenance payments.

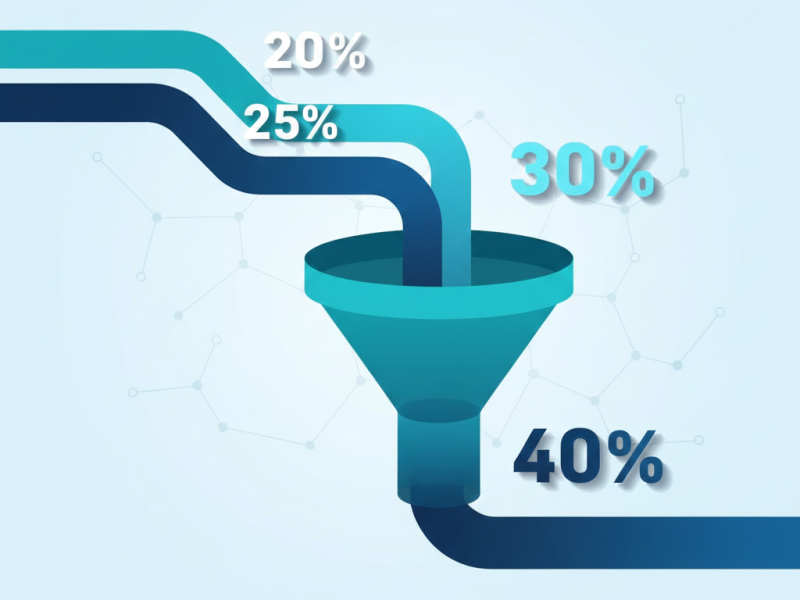

Here’s what these formulas actually calculate. Both run two separate calculations and use whichever produces the lower number. For the Lower Formula, you calculate 20% of the payor’s income minus 25% of the payee’s income. For the Higher Formula, it’s 30% of the payor’s income minus 20% of the payee’s income. But then both formulas run a second calculation that effectively sets a ceiling on maintenance.

The 40% Combined Income Ceiling: Understanding the Financial Logic

This is where people often get confused, and it’s actually the most essential part of understanding how maintenance works in New York. The second calculation takes 40% of your combined income and subtracts the lower-earning spouse’s income. This effectively creates a ceiling on maintenance.

Why 40%? The approach is designed so that after receiving maintenance, the lower-earning spouse doesn’t end up with more than 40% of the household income during the marriage. This ceiling prevents maintenance awards from being so high that they reverse the income disparity or create an unsustainable burden on the payor.

Let me show you why this matters with a real example. Suppose you earn $200,000 and your spouse earns $80,000, with no child support involved. Using the Higher Formula’s first calculation: 30% of $200,000 equals $60,000, minus 20% of $80,000, which is $16,000, giving you $44,000. But when you run the second calculation, 40% of the combined $280,000 is $112,000, minus the payee’s $80,000, leaving just $32,000. Because this second calculation is lower, $32,000 becomes the guideline amount.

This produces a counterintuitive result. Using just the percentage-based calculation suggested a $44,000 payment, but the 40% ceiling brought it down to $32,000. The formula essentially says that giving the lower-earning spouse $32,000 in maintenance on top of their $80,000 income brings their income to $112,000, which is precisely 40% of the combined income. That’s where New York draws the line.

In litigation, you’re stuck with this result regardless of whether it makes sense for your situation. In mediation, this guideline becomes a starting point for discussing what actually works for both of you. Maybe the $32,000 figure feels right, or maybe your specific circumstances suggest a different number makes more sense. The difference is you’re making that decision together rather than having it imposed on you.

The $228,000 Income Cap and What It Really Means

As of March 2025, New York caps the payor’s income at $228,000 for purposes of the maintenance formula. This doesn’t mean maintenance stops if you earn more than this amount. Instead, the formula only applies automatically to income up to that threshold.

If your income exceeds $228,000, the formula first calculates what it would produce on the capped amount. Then, for income above the cap, you and your spouse have discretion to agree on additional maintenance after considering factors like the length of your marriage, your respective ages and health, each person’s earning capacity, and the standard of living you established during the marriage.

This creates an important planning consideration. If you’re the higher-earning spouse making $300,000, the formula will automatically calculate maintenance on $228,000 of that income. The remaining $72,000 becomes a matter of negotiation. In mediation, this discretionary portion gives you room to discuss what feels fair given your specific circumstances, taking into account everything from your variable compensation structure to future career plans to your children’s needs. In litigation, you’re leaving these decisions to someone who knows nothing about your family and has no stake in finding a solution that actually works.

The Self-Support Reserve: The Floor Beneath the Formula

While the 40% combined income calculation creates a ceiling, the self-support reserve creates a floor. As of March 2025, this figure is $21,128 annually. This represents 135% of the federal poverty guideline for a single person and is designed to ensure that paying maintenance doesn’t leave you unable to meet your basic needs.

If the formula produces a maintenance award that would drop your income below $21,128, the amount gets automatically adjusted. Instead of paying what the formula calculates, you’d pay only the difference between your income and the self-support reserve. If your income is already below the self-support reserve, there’s a presumption that no maintenance should be awarded at all.

This provision recognizes a fundamental financial reality. You can’t sustain New York spousal maintenance payments if doing so leaves you without enough income to cover your own housing, food, and basic expenses. The self-support reserve ensures the formula doesn’t create an impossible financial situation for the payor.

Why Understanding These Thresholds Matters for Your Planning

These numbers aren’t just abstract concepts. They’re critical reference points for your financial planning during divorce. Knowing that the formula caps at $228,000 helps you understand which portion of your income negotiation will be formula-driven and which will be discretionary. Understanding the self-support reserve helps you gauge whether you’re in a situation where the standard formula even applies, or whether you’ll need to focus on demonstrating why a reduced amount, or no maintenance, is appropriate.

The 40% ceiling is significant for financial planning because it tells you the maximum percentage of combined income the payee spouse could receive. If you’re the lower-earning spouse, this helps you set realistic expectations. If you’re the higher-earning spouse, it helps you understand the upper boundary of your potential obligation under the formula.

These thresholds also get periodically adjusted based on changes in the Consumer Price Index and federal poverty guidelines. The figures I’ve shared here are current as of March 2025, but they’ll likely increase in future years. This is worth considering if you’re negotiating a long-term maintenance arrangement.

The Financial Reality Behind the Formulas

Here’s what’s important to understand about why New York designed the system this way. The two-formula approach recognizes that child support obligations reduce the income available for maintenance. The 40% ceiling acknowledges that, while one spouse may have earned less during the marriage, maintenance shouldn’t result in that spouse receiving a disproportionate share of the total income. The income cap recognizes that extremely high earners need individualized analysis rather than formula-based calculations. And the self-support reserve ensures the payor can still meet basic needs.

These aren’t arbitrary numbers. They reflect careful consideration of how to balance both spouses’ needs while recognizing the economic realities of divorce. When you’re sitting across from your spouse in mediation, understanding this financial logic helps you have more productive conversations about what feels fair given your specific situation.

The formula provides a starting point for negotiations, not an immutable answer. In mediation, you have the flexibility to discuss whether the guideline amount makes sense for your circumstances, whether paying it over a different time period would work better for both of you, or whether other factors in your situation warrant a different approach. The key is understanding what the formula produces and why, so you can have informed discussions about whether it fits your needs.

Making the Formula Work for Your Family, Not Against It

You’re navigating something genuinely complex here, and feeling uncertain about these calculations is entirely normal. But here’s what you need to understand. In litigation, these formulas get applied mechanically by someone who doesn’t know your family, your plans, or what matters most to you. The result might be technically correct, but it would be utterly impractical for your actual situation.

In mediation, these same formulas become tools for discussion rather than rigid mandates. You can explore whether the guideline amount makes sense given your specific income structure, whether stepdown provisions might work better than a flat payment, or whether other considerations in your situation should affect the final number. That’s especially important if your compensation includes bonuses, stock options, or other forms of variable income that make rigid formulas problematic.

We help couples navigate these calculations with an understanding that goes beyond just plugging numbers into formulas. With an MBA in finance and years of experience working with complex compensation structures, we can help you understand not just what the formula produces, but whether that result makes financial sense for your family’s future. We don’t just calculate the guideline amount and call it done. We help you think through how maintenance fits into your complete financial picture and work with both of you to find solutions that provide security for the lower-earning spouse while remaining sustainable for the payor.

The difference between mediation and litigation isn’t just about saving money or avoiding court. It’s about maintaining control over decisions that will shape your financial life for years to come. Working with a mediator who combines financial expertise with years of mediation experience gives you the best chance of reaching an agreement that works not just on paper, but in reality.

FAQs About Spousal Maintenance in New York

The Mediation Advantage for Maintenance Discussions

Throughout these FAQs, you’ve seen references to mediation as an alternative to litigation. In litigation, attorneys fight over what guidelines produce and argue about how factors apply. You’re spending tens of thousands on adversarial processes that often produce outcomes neither party accepts. For co-parents, this poisons the relationship foundation you need for years ahead.

In mediation, you’re working together to understand what the guidelines say, whether they fit your circumstances, and what alternatives might work better. When you combine that collaborative process with genuine financial expertise—the ability to model scenarios, calculate present values, analyze tax impacts, and structure creative solutions—you get agreements that are both fair and sustainable.

That’s what makes the difference between maintenance arrangements that work and ones that create ongoing conflict.