If your household income during the marriage came from a straightforward W-2 salary, calculating alimony is relatively simple math. But what if your spouse receives a $150,000 base salary, plus annual bonuses ranging from $50,000 to $200,000? Or what if significant compensation comes from stock options that vest over several years? Or what if one of you owns a business where the income reported on tax returns doesn’t tell the whole story?

These situations make alimony calculations significantly more complex. And if you’re the spouse without a finance background, trying to understand what’s fair, it can feel overwhelming. You know the marital lifestyle was comfortable, but you’re not sure how to translate variable income and complex compensation into a monthly alimony number that makes sense.

As a divorce mediator with an MBA in Finance, my background makes the most significant difference for couples in this area. While I can’t give you legal advice, I can help you understand how to analyze complex income and use that analysis to negotiate alimony that’s fair and realistic for your specific situation.

Please note: The financial examples in this post are for illustration purposes only and use simplified scenarios with round numbers to demonstrate concepts. Every divorce situation is unique, with different income levels, expenses, family circumstances, and financial complexities. These examples are not predictions of what you should expect in your specific case. I’m not a lawyer and cannot provide legal advice or tell you what alimony amount you’ll receive or pay.

Why Complex Income Makes Alimony More Complicated

Alimony calculations start with a fundamental question: what income is available to pay support, and what income does the other spouse need to maintain a reasonable standard of living?

When someone earns $120,000 in salary every year like clockwork, that question is straightforward. But when income varies significantly year to year, or when compensation comes in forms other than salary, you’re dealing with much more complex questions. Do you use the best year? The worst year? An average? How do you account for compensation that hasn’t vested yet? What if the business income could be higher if someone made different decisions?

If you leave these questions to a judge who doesn’t know your industry, your compensation structure, or your actual financial life, you might end up with alimony based on assumptions that don’t match reality. In a 30-minute hearing, there’s no time to dig into three years of bonus history or analyze add-backs from business expenses. That’s why mediation is so valuable for couples dealing with complex income—you can dig into the details together and make informed decisions.

Please note: The financial examples in this post are for illustration purposes only and use simplified scenarios with round numbers to demonstrate concepts. Every divorce situation is unique, with different income levels, expenses, family circumstances, and financial complexities. These examples are not predictions of what you should expect in your specific case. I’m not a lawyer and cannot provide legal advice or tell you what alimony amount you’ll receive or pay. The purpose of this post is to help you understand how complex income gets analyzed in mediation so you can have more informed conversations about your own situation.

Analyzing Bonuses and Variable Compensation

Let’s start with bonuses and variable compensation, as these are extremely common, especially for people in sales, finance, or executive roles.

The first question is whether bonuses are truly variable or essentially guaranteed. Some “bonuses” are really just deferred salary paid annually. Others are genuinely performance-based and fluctuate significantly. Understanding the difference matters enormously.

In mediation, I help couples review their financial history over three to five years. What’s the pattern? Has the bonus been consistent? Is there an upward trend as the person advances in their career? Or are bonuses genuinely unpredictable based on company performance or personal sales numbers?

Let’s say someone has a $150,000 base salary and earned bonuses of $80,000, $120,000, $95,000, $140,000, and $110,000 over the past five years. We can estimate an average bonus of about $110,000, bringing our total income to $260,000 annually. After taxes, that’s roughly $170,000 available annually, or about $14,000 monthly.

But we also need to look forward. Is the higher-earning year repeatable? Was the lower year an anomaly? This is financial analysis, not guesswork. If we determine the realistic going-forward income is $150,000 base plus $110,000 average bonus, we can work through the calculation. The payor has $14,000 in monthly after-tax income and needs $7,000 for expenses, leaving $7,000 potentially available. The recipient spouse earns $40,000 annually (about $3,000 monthly after tax) and needs $5,000 monthly to maintain reasonable stability. The gap is $2,000 per month, which serves as the basis for alimony.

Here’s where mediation gives you flexibility: you can structure alimony to account for variable income. Perhaps base alimony at $1,500 monthly, calculated from salary alone, with an additional 20% of any bonus paid within 30 days of receipt. Or maybe you average the bonuses and build that into regular $2,000 monthly alimony, with an understanding that if income drops significantly for two consecutive years, there’s a mechanism to revisit it.

These creative structures are possible in mediation but challenging to achieve if you’re leaving decisions to someone who doesn’t understand your compensation in a brief court hearing.

Understanding Stock Options, RSUs, and Equity Compensation

Stock-based compensation adds another layer of complexity. There are different types—incentive stock options, non-qualified stock options, restricted stock units (RSUs), performance shares—and they all work differently for tax and timing purposes.

The key questions are: When does this compensation vest? What’s it actually worth? And how should it factor into alimony calculations?

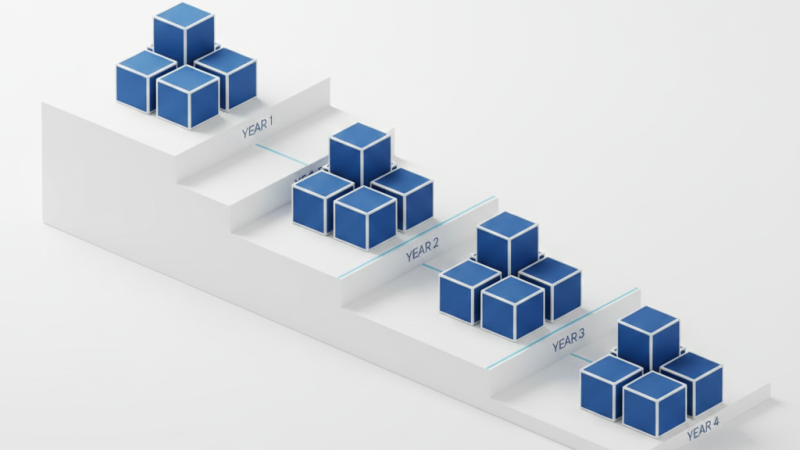

Let’s say someone receives RSUs worth $100,000 that vest over four years—$25,000 per year. Should that be counted as $100,000 of current income? Or $25,000 per year as it vests? And what if the stock price changes significantly—should alimony adjust based on market fluctuations?

Here’s a realistic scenario: Someone earns a $120,000 salary plus $25,000 in vesting RSUs annually. After taxes, that’s about $95,000 in actual take-home, or roughly $8,000 monthly. If they need $5,000 monthly for their expenses and their spouse earns $50,000 annually (about $3,500 monthly after tax), the gap is $1,500 monthly. We might structure base alimony at $1,500 per month from regular income, with a provision that, when larger equity grants vest (e.g., $50,000 or more), an additional percentage is paid as a one-time alimony supplement.

In mediation, I help couples understand the vesting schedule, the tax implications, and the realistic after-tax value of equity compensation. We can model different scenarios. Perhaps we count unvested equity at a 30% discount, given it’s currently inaccessible and at market risk. We could agree to revisit alimony once a significant equity grant vests. Maybe we prioritize giving equity to one spouse in the property division rather than factoring it into ongoing alimony calculations.

The financial modeling here gets sophisticated, which is exactly where having an MBA makes a difference. We’re not just looking at what the equity is worth on paper—we’re analyzing what it means for actual cash flow and post-tax dollars available.

Business Ownership and Income Analysis

Business ownership is often the most complex income situation for alimony purposes. Tax returns for business owners rarely tell the complete story of their actual income or lifestyle.

Here’s why: business owners often run personal expenses through the business. The company covers the car, phone, meals, travel, and sometimes even housing-related costs. The tax return might show $150,000 in income, but the actual lifestyle being funded is much higher.

In mediation, we do what’s called “income available for support” analysis. We look beyond the bottom line on the tax return and identify personal expenses being paid by the business (also known as “add-backs”). This isn’t about being accusatory—it’s about getting an accurate picture of what income is actually available.

We also look at discretionary spending within the business. Perhaps the company’s lower profit is due to the owner maximizing retirement contributions or holding cash for future growth. These are legitimate business decisions, but they affect the alimony analysis.

Here’s a real example from my practice: A business owner reported $175,000 in income on tax returns. But detailed analysis revealed $30,000 in company car expenses (personal use), $15,000 in meals and entertainment that were substantially personal, $20,000 in travel that included family vacations, and $10,000 in other personal expenses run through the business—total add-backs: $75,000. Combined with the $175,000 reported income, the real income available for support was $250,000—43% higher than what appeared on the tax return.

That changes the alimony conversation dramatically. At $175,000, after-tax income might support $2,000 monthly in alimony. At $250,000, we’re looking at a range of $3,500 to $4,000 monthly as reasonable. That’s a $1,500 to $2,000 monthly difference based on accurate financial analysis.

This level of analysis requires financial sophistication and access to detailed business records, which is why full financial disclosure in mediation is so important.

Tax Implications Matter More Than You Think

Here’s something many people don’t realize: alimony isn’t tax-deductible for the payor or taxable to the recipient for divorces finalized after 2018. This fundamentally changed alimony negotiations.

Under the old rules, if someone in a high tax bracket paid $50,000 in alimony, their after-tax cost might only be $32,000 because of the deduction. Now they’re paying the full $50,000 from after-tax dollars. This means the actual dollars available for alimony are lower than they were before 2018.

When analyzing complex income, we need to consider it on an after-tax basis. If someone receives a $100,000 bonus, they’re not receiving $100,000 in spendable income. After federal, state, and payroll taxes, they might net $60,000. That’s what’s actually available.

Let’s run a complete example: someone earns a $200,000 base salary plus a $100,000 bonus, for a total of $300,000. After taxes (roughly 40% effective rate), they net about $180,000 annually, or $15,000 monthly. They need $8,000 per month for expenses. Their spouse needs $6,000 per month and currently earns $60,000 (about $4,000 per month after tax). The gap is $2,000 per month, which establishes the reasonable alimony range.

But if we hadn’t done the after-tax analysis and had just worked from gross income, we might have thought $5,000 per month in alimony was reasonable when the actual available cash flow doesn’t support it.

In mediation, I help couples run these tax calculations accurately so you’re negotiating based on real after-tax cash flow, not gross income figures that overstate what’s actually available.

The Mediation Advantage for Complex Income

When income is complex, mediation’s cooperative approach becomes even more valuable. You can dig into the details together, share complete financial information, and model different scenarios to see what actually works.

You can structure creative solutions that match your specific compensation pattern. You can account for vesting schedules, business cycles, and variable bonuses in ways that feel fair to both of you.

Most importantly, you maintain control over how your income is analyzed and how that analysis is applied to alimony. If you go to court, a judge is making assumptions about your compensation based on a brief hearing and limited financial documents. They might use the wrong year’s bonus. They might miss significant add-backs. They might not understand your industry’s compensation structure. You both end up with alimony amounts that don’t reflect your actual financial realities.

Building Agreements That Work Now and in the Future

If your divorce involves bonuses, equity compensation, or business ownership, you need someone who can perform sophisticated financial analysis to arrive at fair alimony. This isn’t something you can calculate with a simple online calculator or a rule of thumb.

This is precisely where financial complexity expertise makes the most significant difference. With an MBA in Finance and experience working through these specific situations with hundreds of couples, I can help you understand the complete compensation picture—not just what shows up on a W-2 or tax return, but what income is really available and how it should translate into reasonable alimony.

We don’t just calculate a number for today. We think ahead to how your agreement will work when circumstances change. What happens when the big equity grant vests in three years? What happens if the business has a down year? What happens when bonuses increase as someone advances in their career? Building those provisions into your agreement from the start prevents you from needing to renegotiate or modify later.

That future-focused planning approach means you’re creating an agreement that adapts to real life instead of becoming outdated the moment income changes. You understand precisely how alimony adjusts when bonuses fluctuate, when equity vests, and when business income varies. You’re not left wondering whether every change requires going back to modify the agreement.

In mediation, we can do the detailed work necessary to understand your complete compensation picture, model different alimony scenarios based on various income projections, and structure an agreement that reflects financial reality rather than assumptions. We can build in the flexibility and clarity you need when income is complex.

If you’re facing alimony questions in New Jersey when income includes bonuses, stock options, or business ownership, mediation with the right financial expertise makes all the difference. You deserve an approach that cuts through the complexity, accurately analyzes your situation, and helps both of you reach an agreement based on real numbers rather than guesswork.