If you’re facing divorce in New York, spousal maintenance (often called alimony) is likely one of your biggest concerns. Whether you’re worried about maintaining your standard of living or anxious about your financial obligations, understanding how maintenance works is essential.

New York’s maintenance system has become increasingly complex over the past decade, with statutory formulas, income caps, advisory duration guidelines, and tax complications that can leave even financially sophisticated people confused. Add business ownership, variable income, significant assets, or the desire for creative solutions—and it’s easy to feel overwhelmed.

This guide walks you through everything from basic formula calculations to sophisticated negotiation strategies, always with an eye toward both the numbers and the human relationships at stake.

Understanding the Foundation

Before you can make smart decisions about maintenance, you need to understand how New York’s system actually works.

How Does New York’s Spousal Maintenance Formula Actually Work? New York uses two different formulas depending on whether child support is involved. With child support, the state uses a 20% minus 25% calculation; without, it’s 30% minus 20%. The real complexity emerges with the 40% combined income ceiling calculation. As of 2025, New York’s income cap sits at $228,000, with a self-support reserve of $21,128. Understanding these thresholds reveals the financial logic: balancing income redistribution while preventing unreasonable results.

The Tax Puzzle. For divorces finalized after January 1, 2019, federal law changed: maintenance payments are no longer tax-deductible for the payor or taxable income for the recipient. However, New York state law continues to treat maintenance as deductible to the payor and includable in the recipient’s income. This split significantly complicates financial planning. You need financial expertise to model actual after-tax impact properly. Most people focus on the gross amount and miss tax implications that can swing thousands of dollars.

Income Above the Cap. The formula applies only to income up to $228,000. For income above that, courts have discretion based on statutory factors. This discretionary analysis becomes the heart of negotiations in higher-income cases—exactly where mediation with financial expertise provides significant advantages over litigation.

Duration and Timing Strategy

Understanding how much maintenance might be paid is only half the equation. How long those payments continue matters just as much.

Duration Guidelines. New York uses guidelines that provide ranges. For marriages lasting 0-15 years, advisory guidelines suggest 15-30% of the marriage length. Marriages of 15-20 years suggest 30-40%, while marriages over 20 years suggest 35-50%. These are ranges, not mandates. A twelve-year marriage might result in maintenance for roughly 2-4 years, depending on factors such as age, employability, and career sacrifices. You need to model different scenarios and their long-term impacts.

Two Distinct Phases. New York distinguishes between temporary maintenance (during the divorce process) and post-divorce maintenance (after the divorce is finalized). Receiving temporary maintenance doesn’t automatically mean you’ll receive post-divorce maintenance. The strategic value lies in structuring the transition properly, with step-down provisions and rehabilitative plans coordinated with realistic timelines.

Financial Complexity and Special Situations

Many couples face circumstances that don’t fit neatly into statutory formulas, requiring sophisticated financial analysis.

Trading Property for Maintenance. One common strategy is to offer a larger share of marital assets in exchange for reduced or eliminated maintenance. This appeals to payors who value finality and recipients who need capital. However, evaluating these trades requires rigorous analysis: calculating present value of maintenance streams, assessing liquidity and tax implications, understanding opportunity costs, and evaluating risk factors. This is exactly where an MBA in finance makes the difference—many mediators lack the training to guide you through these calculations properly.

When Income Isn’t Straightforward. Business owners, self-employed professionals, commission-based earners, and those with significant investment income present challenges. You need to examine business financial statements, normalize variable income, determine how to treat income from distributed assets, and account for deferred compensation, stock options, and bonuses. Getting these calculations right requires financial sophistication well beyond basic tax return review. This is where financial expertise dramatically changes what’s possible in mediation.

Strategic Mediation Approaches

Understanding the legal framework is essential, but successful maintenance negotiations require strategic thinking.

Knowing When to Opt Out. While New York provides presumptive formulas, nothing requires divorcing couples to follow them. Deviation might be appropriate when the formula produces results that don’t match your circumstances, when property trade-offs better serve both parties, when tax considerations suggest different structuring, or when creative solutions address needs the formula ignores. Opt-out agreements must be fair and reasonable with full financial disclosure. This flexibility is one of mediation’s most valuable advantages over litigation, where judges typically apply rigid formulas.

Using Financial Projections. Creating multi-year financial projections helps both parties understand long-term implications of different scenarios. Rather than arguing about budgets, objective financial modeling depersonalizes emotionally charged discussions. You can project cash flow under various scenarios, model how maintenance interacts with property division, analyze paths to self-sufficiency, and stress-test assumptions. When both parties see precise data, conversations shift from positions to problem-solving. This sophisticated financial modeling requires genuine financial expertise that many mediators don’t have.

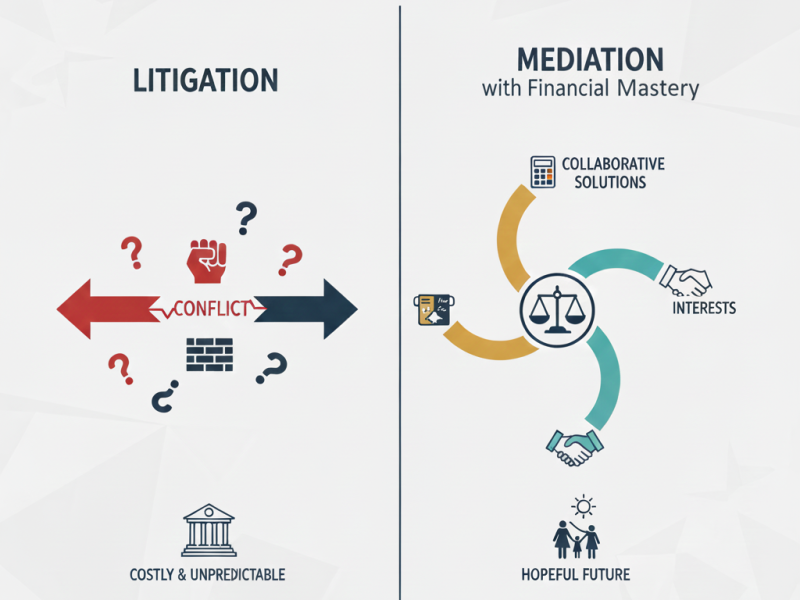

Preserving Relationships. For couples with children, how you handle maintenance negotiations affects your ability to co-parent for years to come. Effective mediation techniques make difficult conversations productive: separating positions from underlying interests, framing maintenance as a shared problem rather than a win-lose battle, reality-testing assumptions without blame, and generating multiple options. In litigation, the adversarial process teaches you to see your co-parent as an opponent—precisely the wrong foundation for co-parenting ahead.

Why Financial Expertise Changes Everything

Throughout this guide, you’ve seen references to present value calculations, tax impact modeling, cash flow projections, business income analysis, and sophisticated financial scenarios. This isn’t accidental—it’s the heart of what makes maintenance negotiations successful.

Many mediators come from legal or mental health backgrounds and lack the financial training to guide you through this complexity. They can facilitate conversations and help you communicate better. Still, they can’t build the economic models, calculate present values, analyze complex compensation structures, or stress-test assumptions with the rigor these decisions require.

With an MBA in finance, we actively bring this financial modeling capability to the mediation process. We don’t just discuss options conceptually—we actually build the models, run the scenarios, show you the numbers, and help you understand the long-term implications. That’s the difference between passive facilitation and active guidance. It’s the difference between generic mediation and working with someone who has both mediation skill and financial expertise.

In litigation, you’re fighting over positions through attorneys while paying for competing financial experts to support adversarial arguments. In mediation with financial expertise, you’re collaboratively exploring scenarios, modeling options together, and finding solutions that actually work for both of you.

Moving Forward with Confidence

Navigating New York’s spousal maintenance system requires understanding complex formulas, thinking strategically about tax implications and timing, analyzing sophisticated financial trade-offs, and managing emotionally charged conversations—often all at once.

Whether you’re just beginning to explore divorce options or deep in negotiations, remember that maintenance decisions don’t exist in isolation. They interact with property division, tax planning, parenting arrangements, and your long-term financial goals.

The most successful outcomes come from understanding both the technical rules and the strategic possibilities, recognizing where the law provides flexibility and where it constrains options, and approaching negotiations as an opportunity to solve shared problems rather than as a battle to win. That’s what mediation with genuine financial expertise delivers—and it’s exactly what makes the difference between agreements that work and agreements that create problems down the road.

“When you think about divorce, legal issues might come to mind first. However, three of the four main issues that need to be resolved during divorce are actually financial in nature (with parenting being the fourth).

This is why having a mediator with strong financial expertise can be particularly valuable in reaching a well-informed, sustainable agreement.”

Joe Dillon, MBA

| Divorce Mediator & Founder

FAQs About Spousal Maintenance in New York

The Mediation Advantage for Maintenance Discussions

Throughout these FAQs, you’ve seen references to mediation as an alternative to litigation. In litigation, attorneys fight over what guidelines produce and argue about how factors apply. You’re spending tens of thousands on adversarial processes that often produce outcomes neither party accepts. For co-parents, this poisons the relationship foundation you need for years ahead.

In mediation, you’re working together to understand what the guidelines say, whether they fit your circumstances, and what alternatives might work better. When you combine that collaborative process with genuine financial expertise—the ability to model scenarios, calculate present values, analyze tax impacts, and structure creative solutions—you get agreements that are both fair and sustainable.

That’s what makes the difference between maintenance arrangements that work and ones that create ongoing conflict.