You and your spouse were partners.

And during your marriage, worked hard to achieve your financial goals and enjoy a comfortable lifestyle.

But now that you’re facing the end of your marriage, you want to know how to split assets in a divorce - and how who gets what is determined. You also want to know if you can keep your premarital assets in divorce.

And if you and your spouse will get a say in how to divide assets in divorce in a fair and equitable way.

For many couples, division of assets in divorce (and debt) is one of the most difficult issues to resolve. But there are some things you can do to protect your assets and make sure they don’t wind up wasted on a contested divorce in court or outrageous attorney fees.

In this post we’ll cover:

- The differences between separate property and marital property, and how property can change from one form to another and sometimes be both;

- How dividing assets in divorce depends on the state which you live in;

- How the method you use to end your marriage can also significantly impact how division of assets and debts will occur;

- And how to maintain control over your divorce asset split.

Oh, and before we begin, you need to know that this post is for informational purposes only and should not be construed as legal advice, financial advice, or counsel.

OK, let's get started...

Splitting Assets in Divorce Typically Refers to Marital Property, Not Separate Property

Generally speaking, assets are either marital property or separate property.

Marital property is typically any asset acquired by either spouse during the marriage, regardless of who made the purchase, or whose name is on the title.

Separate property is usually any asset owned by either spouse prior to the marriage, an inheritance either spouse received prior to or during the marriage, gifts given to each other, or received from others, and proceeds received for pain and suffering in a personal injury lawsuit.

When it comes to dividing assets in a divorce, marital property are considered divorce assets, whereas non marital assets are not.

But Separate Property Can be Converted into Marital Property

Let’s say you owned real property such as a home prior to the marriage and after you got married, you added your spouse to the title so you could be co-owners.

In this example, you converted separate property into marital property.

Or you each had individual checking accounts before you got married, then combined them into one joint account. That commingled property is now also considered marital property.

Incidentally the opposite is also true - you can convert marital property to separate property if you and your spouse both agree in writing.

And Some Divorce Assets Can be Both Separate Property and Marital Property

Let’s say when you first started your current job you were single.

You enrolled in the company’s 401(k) plan and for the next 6 years, saved furiously. And after you got married, you continued to contribute to that account.

Flash forward 15 years - and you and your spouse are divorcing.

In this example, your retirement benefits - the 401(k) - is both separate property and marital property.

- Dividing property that is both separate and marital is a complex topic outside the scope of this post.

Separate Assets That Appreciate During the Marriage

What happens if you or your spouse owned a rental property prior to marriage that was completely self-sustaining - meaning, no marital funds were used for its management or upkeep.

Then, at the time of your divorce, it had doubled in value.

If the appreciation in the value of the house was due to market forces outside your control (passive), then that appreciation is most likely considered non marital property.

But if the rental property increased in value because you both spent your free time renovating and improving it, then possibly yes, that growth could be considered marital.

In Divorce Splitting Assets May be Different Depending on Where You Live

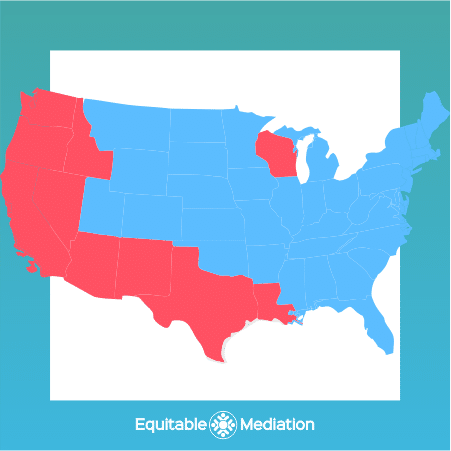

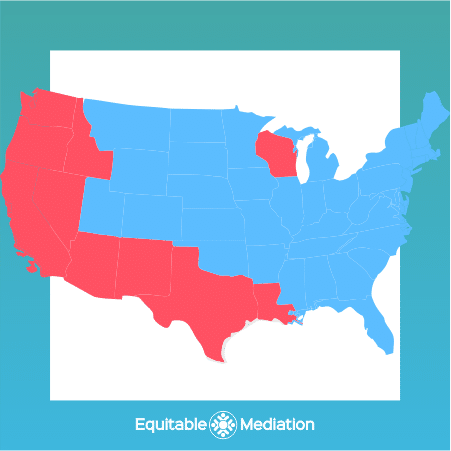

Here in the United States, property in a divorce is divided using one of two different methodologies: either Equitable Distribution or Community Property Division.

In Community Property states like California, Washington State and 7 others, both spouses are generally considered equal owners of all marital (community) property and employ a 50-50 split.

Whereas in Equitable Distribution states like New Jersey, New York, Illinois, Pennsylvania, Michigan and 36 others, the division of a couple’s marital property and debt should be fair and equitable, but do not necessarily need to be equal.

So as you can see, the state you live in can play a role in how to divide assets in a divorce.

The Method You Use to End Your Marriage Will Significantly Impact How to Split Assets in a Divorce

Regardless of whether you live in a community property state or an equitable distribution state, you and your spouse actually have a lot of flexibility to come to an agreement you both find fair.

If you can work together, you can maintain control over your divorce division of assets.

But if you can’t (or refuse to) work together, it will be very difficult, if not impossible, to predict the outcome of how your marital property (and debt) will be divided.

Because you’ll need to hire divorce lawyers to argue on your behalf. And if they can’t help you and your spouse come to agreement, you’ll have no choice but to battle it out in family law court.

Where a family law judge will decide property division for you.

And unfortunately, there’s a good chance neither of you will wind up with something you find fair or that meets your needs or interests.

That’s why it’s better to work with your spouse to negotiate dividing assets in divorce - out of court.

But what if you and your spouse want to maintain control of division of assets, but you don’t understand the complexities of your situation?

Especially because not all assets and liabilities are the same.

Some may be pre-tax like retirement benefits, while others are post-tax like checking accounts. Some may change in value frequently (such as retirement accounts,) while others are quite static.

In other words, what may appear as fair property division on the surface doesn’t necessarily mean it is.

And even if it was, each of you will have a different definition of what’s fair!

Or what if you’re willing to work together to determine your asset split in divorce, but you don’t communicate effectively or get along?

This is all very normal (and common,) given the circumstances!

And as you’ve learned, there are many complexities surrounding divorce and asset division - so it’s often way too difficult for a divorcing couple to try to resolve on their own.

Or you don't understand how the tactical division of assets in divorce works.

Some joint property such as furniture or bank accounts are easier to divide. You each take what you want (and have agreed to,) and that's that.

While other property is far more difficult to divide.

Take for example, a 401(k) or corporate pension plan. Did you know they require a document known as a QDRO to be drafted by an attorney, signed off by a judge, and executed by a plan administrator, before each of you can receive your share?

As you can see by this example (and there are many more like it) there is far more to the distribution of assets in divorce than just taking what you've each agreed to take, and walking away.

That’s why mediation is an ideal solution for splitting assets in a divorce!

With the help of a skilled mediator with a financial acumen like me, you can retain control of your divisible property and at the same time, avoid making costly and significant mistakes in this complicated part of the divorce process.

And you and your spouse can successfully reach an agreement you both agree is an equitable division - instead of letting your future be decided by lawyers or a judge in court!

Want to Protect Your Assets in a Divorce? Mediate!

Using my extensive financial knowledge of the complexities of marital property and marital debt, I’ll help you and your spouse determine which of your income, assets, and debts are subject to division.

I’ll actively guide you through negotiations, while empowering you to take full advantage of the freedom the law gives you to create an agreement you both find fair.

To overcome areas of disagreement, I’ll use a variety of conflict resolution techniques to help you and your spouse communicate more effectively and understand each other’s interests. And I’ll share options to consider and help you understand which assets will be best for your short - and long-term financial security.

Because when it comes to splitting property in divorce, in order to reach an agreement you both find fair and equitable, it’s critical for you to realize the implications of all financial decisions being made.

I’ll also make sure your agreement minimizes tax issues, avoids penalties and improves cash flow whenever possible.

Why be forced to accept a settlement created by a judge or family law attorney when you can have a direct say in your financial future instead?

If you want to be in complete control of your division of assets and liabilities, mediate your divorce with Equitable Mediation.

And if child support and/or alimony (also known as spousal support or spousal maintenance, depending on the state you live in) are relevant issues in your divorce or separation, I can help you resolve those, too.

So if you and your spouse have agreed you want to end your marriage and both want to mediate, take the next step and book a mediation strategy session for the two of you.

Book a Strategy Session

The choices you make before you start your divorce are critical.

But you can only make smart choices if you take the time to prepare and get educated first!

Learn How

Other Useful Resources: