You and your spouse worked hard throughout all the years of your marriage.

You bought a house, saved for retirement, maybe even treated yourself to a new car or truck.

But now that you’re divorcing, you have questions about what is equitable distribution, how to know what is marital property versus non-marital property, and just who gets what in a divorce - and how it's determined.

You want to make sure that all the money you worked so hard for doesn’t wind up getting wasted on legal fees.

And you don’t get the short end of the stick when it comes to the equitable division of marital property in your divorce proceedings.

What is Equitable Distribution?

Definition of equitable distribution: The fair, but not necessarily equal, division of marital assets and liabilities acquired during a marriage.

There are a few things you need to understand about the challenges surrounding the equitable division of marital property and debts in a divorce:

- The law is extremely vague on how to resolve this financial issue;

- This topic has less to do with equitable distribution law and more to do with money and negotiation;

- There is more than meets the eye on this subject and in the majority of cases, this issue is much too complex to try to resolve on your own.

That's why you’ll get the most equitable divorce settlement by mediating with us.

"New Jersey is an equitable distribution state, and so is Illinois, Pennsylvania, New York, Michigan, and 36 other states. So whatever the parties deem to be fair and equitable is how their marital property and liabilities will be divided.

But not all assets or liabilities are created equal. Some may be pre-tax, while others are post-tax. Some may change in value frequently, while others are quite static. So what may appear fair on the surface doesn’t necessarily mean it is.

And there’s a lot more to this topic than splitting everything down the middle.

This is a complex financial matter and in order to get a settlement agreement that's fair to each spouse, it’s critical to work with an experienced divorce mediator with a financial acumen like me."

- Divorce Mediator Joe Dillon

In divorce who gets what and the meaning of fair is different for everyone.

Let’s take a closer look at the first part of the definition of equitable distribution:

“The fair, but not necessarily equal division...”

How do you define fair?

Is it 50/50?

60/40?

Some other permutation?

To better explain the concept of “fair, but not necessary equal,” take this example of Bob and Sally who are meeting for lunch at their favorite pizza place:

It’s Monday and Bob had a super-busy morning at work. Because he was caught up in back to back meetings, he skipped breakfast. Bob is starving and lunchtime can’t come soon enough…

On the other hand, Sally forgot she was meeting Bob for lunch and had a late breakfast around 10 o’clock - just two hours before she was scheduled to meet up with Bob. Sally didn’t want to cancel their lunch date, but is still quite full when noon rolls around.

When their pizza arrives at the table, Sally confesses to Bob that she isn’t that hungry. She takes two slices and tells Bob he can have the rest. Bob happily accepts Sally’s offer and polishes off six slices.

What are your thoughts about the division of Bob and Sally’s pizza?

Was the “separation of property” (the pizza) fair to both of them?

On the one hand, maybe you’re thinking it wasn’t fair because Bob ate three times more pizza than Sally. But on the other hand, Sally only wanted two slices, and that’s exactly what she got.

So both Sally and Bob were happy with the way the pie was divided. In other words, each found this outcome to be fair. Even though it wasn’t a 50/50 split.

Because everyone has a different definition of fair (especially when it comes to equitable distribution of property in divorce).

What if Bob and Sally both ate an early breakfast and were equally hungry come lunchtime? In that situation, they would probably have split the pizza in half, each taking four slices.

Sally would have been happy. Bob would have been happy. And both of them would have found this equal distribution fair.

So as you can see, one’s definition of fair can change based on the situation.

What do these examples have to do with the equitable distribution of property in a divorce?

Whether you’re dividing slices of pizza between friends or an asset in a divorce, who gets what and the concept of fair is in the eye of the beholder.

What you think is fair to you might not be fair to your spouse, and vice versa.

Not only that, but your definition of fair might vary from issue-to-issue.

For example, you might think a 50-50 split of your joint checking account is fair but you want your spouse to take on 75% of the credit card debt.

Hopefully you’re starting to understand one of the many challenges surrounding equitable property division in a divorce.

Defining what’s fair and coming to agreements on splitting your marital assets is not always so easy.

Pre-marital vs. marital property is not always easy to identify.

Let’s now take a closer look at the second part of the definition: …Property and debts acquired during the marriage.

As the definition states, when it comes to dividing property and debts in a divorce, the focus is on marital funds and divisible property (and debts) each spouse acquired during the marriage.

On the surface, it seems simple.

Doesn’t it?

But like all issues that need to be resolved in a divorce, pinpointing a pre-marital vs. marital asset isn’t always clear cut.

For example, when Jennifer and Mike got married, they each owned a house.

Jen’s was a four bedroom, 2 ½ bath single family home and Mike’s place was a two bedroom, one bath condo. Since Jen’s home was bigger, and the couple planned on having children, they decided Mike would move into Jen’s place and Jen’s home would become their marital residence.

Jen put Mike’s name on the deed to her house, even though it was separate property - she had owned that home for 6 years prior to marrying Mike, and just like that - Mike became a co-owner of Jen’s house.

But Mike didn’t return the favor and kept his condo in his name only.

Three years later, Mike took equity out of his condo and used the money to put a deck on “their house.”

Now that Jen and Mike are getting divorced, and the deed to Mike’s condo is in his name only, and he took money out of “his” condo to put an improvement (the deck) on a house that Jen wants to keep, how would this issue be fairly resolved?

Because in this and many other real-world examples like it, it’s not so easy to figure out what should be treated as marital property and what should be treated as separate property.

And remember how everyone has a different definition of fair?

Well, it only makes coming to agreements on the division of property in a divorce and in this case, pre-marital assets, more difficult for the parties.

The equitable division of the assets in divorce is just one piece of a larger picture.

In the example above, we discussed the “assets” side of the equation.

But also included is the equitable distribution of liabilities.

And for many divorcing spouses, the debts accumulated during or brought into the marriage are greater than the assets in the marital estate.

Let’s go back to Jennifer and Mike and talk about their $25,000 wedding.

Mike had always dreamed of a big wedding. So he and Jen hosted 300 guests with an all-you-can-eat buffet, open bar and dancing until midnight! No expense was spared and everyone in attendance had the time of their lives.

But as any couple knows, coming up with that kind of cash for a wedding is hard.

So Mike took a loan from his 401(k) to pay for the grand affair. And he’s still paying that liability back today.

Mike and Jen are now divorcing. The loan (liability) was taken prior to the couple's marriage, and since it was Mike who wanted the big wedding and not Jen, but Jen and her friends and family did get to enjoy in the festivities, the question is:

How should Mike’s 401(k) loan be paid back?

What’s fair to both parties?

On the one hand, maybe you’re thinking since it was Mike’s idea to have the big wedding, maybe it should be 100% on him to re-pay the liability. After all, it’s being deducted from his paycheck every week.

And it’s a pre-marital debt.

On the other hand, Jen could have said “no” to the big wedding. But she went along with it and her friends and family happily attended and ate and drank all night.

So maybe you think it’s fair for Jen have to help re-pay Mike’s 401(k) loan.

But how much of it?

And even if she agrees it’s fair that she contribute, how would she do it since it’s being deducted straight out of Mike’s paycheck?

As you can see, defining what’s in and what’s out when it comes to marital property and what is equitable distribution isn’t always easy to figure out, let alone agree upon.

There is more than meets the eye when it comes to equitable distribution and who gets what in a divorce.

Divorce is different for every couple. And because no two couples or situations are exactly the same, there is no “one-size-fits-all” approach to a fairly resolving the division of a couple’s marital assets and liabilities.

And as you’ve been learning, coming to agreement on what each party thinks is a fair divorce settlement and which assets and liabilities are considered marital vs. pre-marital can be quite tricky.

Division of marital assets and liabilities is much too complex for you to try to resolve on your own.

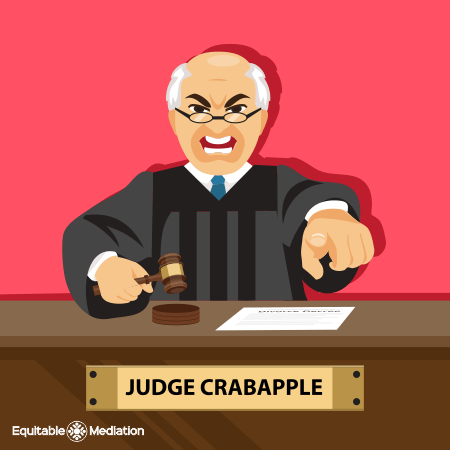

But when the law gets involved in your divorce case, it’s a problem.

So far we’ve talked about the difficulty in defining what’s fair. And the challenges surrounding what constitutes a pre-marital or marital asset or liability.

So far we’ve talked about the difficulty in defining what’s fair. And the challenges surrounding what constitutes a pre-marital or marital asset or liability.

But there’s one more thing you need to be aware of...

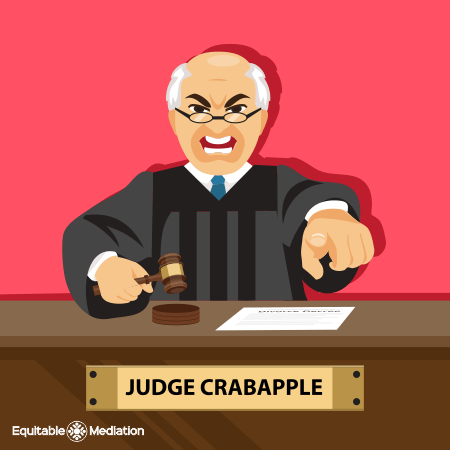

If you hire divorce lawyers who can’t help you and your spouse come to agreement, you’ll have no choice but to battle it out in family law court.

And in a litigated divorce, the division of assets and liabilities is determined by a judge.

But since there are very few laws around this subject, the concept of fair could go right out the window.

A judge doesn’t care about what you think is fair.

They’ll dictate the terms of your settlement and you and your spouse could very well wind up with something neither of you finds fair. Or, doesn’t meet your needs or interests.

Sounds scary, doesn’t it?

Let’s go back to Sally and Bob. In this example, Sally is 61, Bob is 48, they’ve been married 25 years, there’s no dispute about pre-marital assets, and Sally wants the divorce.

Sally and Bob determine the value of all of their marital assets and their two largest are their house, which is worth $400,000, and their retirement account, which is worth $300,000.

Because Sally’s closer to retirement, she’s willing to give Bob the $400,000 house in exchange for the $300,000 in retirement funds. She also wants to downsize and move into a small condo.

In divorce litigation, you really never know which side of an issue a judge will rule in court.

But even if a judge mandates that everything be cut everything in half, in this situation, it’s still not going to be a good outcome for either spouse.

They are far better off negotiating a settlement they each find fair. Instead of having a divorce attorney or a family court judge force one upon them.

Remember, when a judge decides, you don’t get a say.

That’s why it’s better to negotiate division of marital property - out of court. Which is exactly what mediation is all about.

In divorce mediation, you get to decide - and come to an agreement you both agree is fair, instead of letting your future be decided by a stranger.

You will get the most equitable distribution of marital property and liabilities by mediating with us.

Using our extensive financial knowledge of the complex matters of property and divorce, we’ll help you and your spouse determine which of your assets and debts are subject to distribution.

Using our extensive financial knowledge of the complex matters of property and divorce, we’ll help you and your spouse determine which of your assets and debts are subject to distribution.

We’ll actively guide you through negotiations on areas of disagreement while empowering you to take full advantage of the freedom the law gives you.

We’ll also make sure your settlement agreement minimizes tax consequences, avoids penalties and improves cash flow whenever possible.

And along the way, educate you about what we’re doing and why - and how it directly benefits you and your children.

And if you weren’t the spouse who managed the household finances, not to worry. We’ll balance the playing field by taking the time to explain in detail what everything means when it comes to property division and how it will impact you. Now, and in the future.

Allowing the parties to play an active role in helping create an agreement they both find fair and equitable.

Equitable Mediation enables you to have an equitable divorce settlement.

Early in the process?

The choices you make before you start your divorce are critical.

But you can only make smart choices if you take the time to prepare first!

Other Useful Resources:

Community Property States:

- California, Washington, Arizona, Idaho, Louisiana, Nevada, New Mexico, Texas, and Wisconsin

Equitable Distribution States:

So far we’ve talked about the difficulty in defining what’s fair. And the challenges surrounding what constitutes a pre-marital or marital asset or liability.

So far we’ve talked about the difficulty in defining what’s fair. And the challenges surrounding what constitutes a pre-marital or marital asset or liability. Using our extensive financial knowledge of the complex matters of property and divorce, we’ll help you and your spouse determine which of your assets and debts are subject to distribution.

Using our extensive financial knowledge of the complex matters of property and divorce, we’ll help you and your spouse determine which of your assets and debts are subject to distribution.